The highest bidder in the auction pays the total amount of the property liens to the City and. Lien certificates are required prior to any transfer of real property accounts.

Maryland is a good state for tax lien certificate sales.

Tax lien certificates maryland. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Maryland Tax Lien Certificates. Baltimore City Baltimore Maryland.

A lien certificate PDF indicates the status of any unpaid taxes or charges associated with a real property tax account. A Lien Certificate is generally valid for 45 calendar days from the date listed on the Liens Certificate. Buying a rental property on the other hand may require taking on a mortgage.

The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the City all of which are liens against the real property. Tax Lien Certificates Sec. If you do not see a tax lien in.

In Maryland the tax collector sells Maryland tax lien certificates subject to the property owners six 6 month right to redeem. Harford County Maryland Lien List 9-21-2020 1 files Maryland. Tax sale dates are determined and vary by individual counties.

Carroll County Maryland 410-386-2400. Legal references herein refer to the Tax Property Article of the Annotated Code of Maryland. How much does it cost to obtain a.

Registration rules vary per county but most usually allow bidders to register on the day of the tax sale. Sales are published in the local newspaper and is circulated for 4 successive weeks. Maryland utilizes a tax lien certificate system to collect delinquent property taxes.

Check your Maryland tax liens rules. Maryland Tax Lien Certificates. Buying tax lien certificates is different for every state.

The certification letter is FREE to qualified individuals through appointments only which can be made online or by calling the taxpayer services hotline 1-800-MD TAXES or 410-260-7980. How Do I Buy A Tax Lien. Depending on the county the property owner may redeem by paying the purchase price plus interest at the rate of 6 to 24.

6-24 Balimore City 24 Price Georges County 20 Garrett County 20 Montgomery County 20. The lien transfers to the buyerbidder and they gain the ability to enforce their lien through a unique foreclosure process. 225 North Center Street Westminster MD 21157 Hours 800 AM - 500 PM.

Watch this video to learn everything you need to know. In order to collect money from unpaid property taxes each County in Maryland will sell their lien to the highest bidder. Each County in Maryland has a tax lien bidding process that may be unique to just that county.

Baltimore County Maryland Lein List 10-8-2020 1 files Maryland. The City of Baltimore holds an annual tax lien certificate sale. 6 to 24.

You may be able to purchase tax lien certificates at auction with just a few hundred dollars. Maryland Tax Lien Certificates OTC. Title Categories Publish Date Download.

The certificate of sale acts as evidence of the winning bidders interest in the property during the redemption period. Just remember each state has its own bidding process. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs.

And even real estate investment trusts REITs can require several thousand dollars to buy in. However any lien sheets that are ordered from May 16th through June 30th will be void on July 1st of any given year. A completed application should accompany your payment.

First these investments often have a low threshold for buying in. Maryland is a state that uses tax lien certificates to enforce the collection of delinquent property taxes. Each county andor municipality handles sales differently.

Within 60 days after the tax sale the collector must send you a notice by mail that includes information about the sale and about your right to redeem the home. If you dont pay. Are you wondering how it works in Maryland.

Here is a summary of information for tax sales is Maryland. It is a public online auction of City lien interests on properties. Notice After a Maryland Tax Sale.

The cost is 55 and checks should be made payable to Baltimore County Maryland. The County shall offer tax lien certificates on individual properties via an Internet-based sealed direct bid auction using the high bid premium method as provided for in the Annotated Code of Maryland Tax Property Article 14-817b2 et. Dorchester County Maryland Lien List 9-15-2020 1 files Maryland.

Maryland Tax Lien Certificates How Tax Sales In Md Work Youtube

Maryland Tax Lien Certificates How Tax Sales In Md Work Youtube

How To Buy State Tax Lien Properties In Maryland Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Maryland Mahoney Brian 9781979464499 Amazon Com Books

How To Buy State Tax Lien Properties In Maryland Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Maryland Mahoney Brian 9781979464499 Amazon Com Books

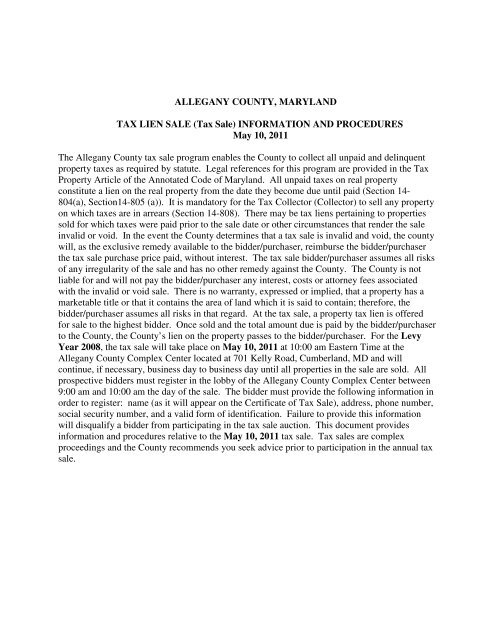

Allegany County Maryland Tax Lien Sale Tax Sale

Allegany County Maryland Tax Lien Sale Tax Sale

Amazon Com How To Buy State Tax Lien Properties In Maryland Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Maryland Ebook Mahoney Brian Kindle Store

Amazon Com How To Buy State Tax Lien Properties In Maryland Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Maryland Ebook Mahoney Brian Kindle Store

Tax Lien Certificates Directory Featuring States That Allow Investing In Tax Lien Auctions By Mail Online And Through Public Foreclosure Sales

Amazon Com How To Buy State Tax Lien Properties In Maryland Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Maryland Ebook Mahoney Brian Kindle Store

Amazon Com How To Buy State Tax Lien Properties In Maryland Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Maryland Ebook Mahoney Brian Kindle Store

Maryland Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Maryland Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Tax Lien Certificate States 21 States And Washington D C Ted Thomas

Tax Lien Certificate States 21 States And Washington D C Ted Thomas

Https Private Banker Online Files Bilder 2016 Nachrichten Kolumnen Artikel 2016 2003 20tax 20liens 20pr C3 A4sentation Pdf

Maryland Tax Lien Basics Auction Otc Tutorial Youtube

Maryland Tax Lien Basics Auction Otc Tutorial Youtube

Office Of The State Tax Sale Ombudsman

Office Of The State Tax Sale Ombudsman

Tax Lien Investing 101 How To Invest In Tax Deeds And Tax Lien Cert

Tax Lien Investing 101 How To Invest In Tax Deeds And Tax Lien Cert

Comments

Post a Comment