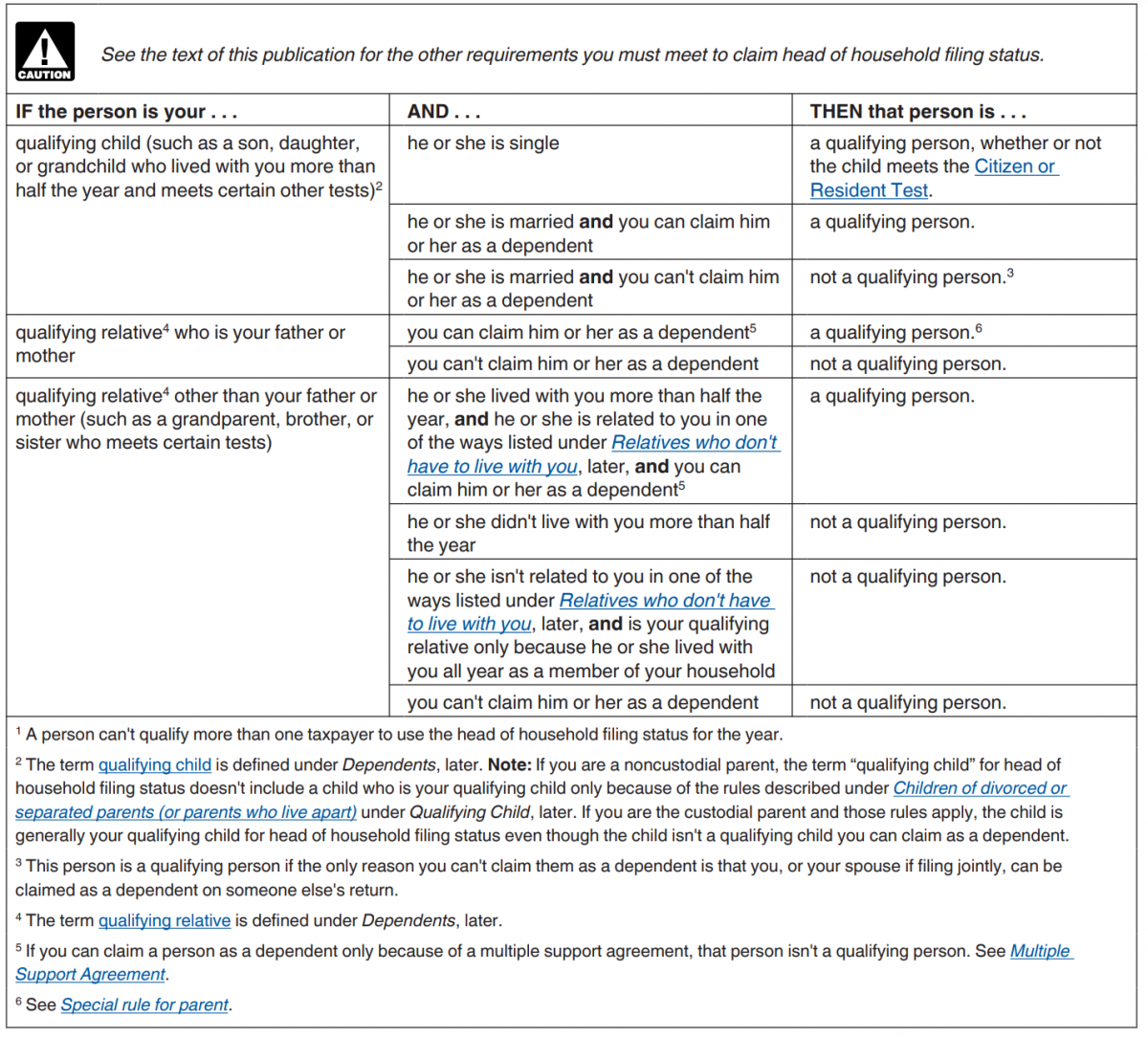

You must have a dependent to qualify for head of the household status but not every dependent allows you to qualify. Normally a taxpayer must be unmarried on the last day of the year in order to file as head of household.

Qualifying Person Qualifying You To File As Head Of Household Aving To Invest

Qualifying Person Qualifying You To File As Head Of Household Aving To Invest

Have a qualifying child or dependent.

How do i qualify for head of household. You might be able to claim head of household HOH filing status if you meet these requirements. However a custodial parent may be eligible to claim head of household filing status based on a child even if he or she released a claim to exemption for the child. Be unmarried on December 31 of the filing tax year.

You can qualify for Head of Household if you. Have a qualifying dependent who lives in your household and you provide their support for at least 50 of the year. Filing as head of household may entitle you to a higher standard deduction lower tax rates and increase the likelihood of qualifying for certain.

A foster child assigned to you by the courts. Choosing this status by mistake may lead to your HOH filing status being denied at the time you file your tax return. Generally to qualify for head of household filing status you must have a qualifying child or a dependent.

If you are a US. Citizen married to a nonresident alien you may qualify to use the head of household tax rates. Were unmarried as of December 31 2020 and.

Items that count toward the cost of your home include things like your mortgage or rent payment taxes you pay on property and utilities. To be eligible to file as head of household you must pass the three questions test fail one of these questions and youre out well at least out of the HOH filing status. That means if your parents cover your rent and other expenses youre out of luck.

Unmarried means a person is not married because he or she is single divorced or legally separated under a separate maintenance decree. You can use eFiles specific. How to Determine a Qualifying Person A qualifying person must meet all the IRS requirements for being your dependent but she also must be one of the following types of individuals to give you head of household status.

Only certain closely-related relatives can be qualifying persons for purposes of meeting the head of household filing status rules. You are considered unmarried for head of household purposes if your spouse was a nonresident alien at any time during the year and you do not choose to treat your nonresident spouse as a resident alien. However your spouse is not a qualifying person for head of.

You can be single and not able to qualify for head of household status if you dont pay over 50 percent of the costs of keeping up your home for the year. To file using the Head of Household status you must meet all of the requirements above. Head of household HOH filing status allows you to file at a lower tax rate and a higher standard deduction than the Single filing status.

The conditions are stricter than those for claiming a dependent. Be sure you meet all the qualifications. Have paid for more than half of the household expenses for the tax filing year.

Pay for more than half of the household expenses Be considered unmarried for the tax year and You must have a qualifying child or dependent. For example you might be able to claim a roommate as your dependent but never as a qualifying person for Head of Household status. A qualifying person lived.

It also includes the cost of. You paid more than half the cost to upkeep your home. To file as head of household you must.

For the purposes of the Head of Household filing status a qualifying person is a child parent or relative who meets certain conditions listed below. Pay at least 50 of the costs of maintaining a household. Your dependent must reside with you for more than half the year and you must provide more than half the total costs of keeping up your home.

You are unmarried or considered unmarried at the end of the year. You paid more than half the cost of keeping up a home for the year. To qualify for head of household on your tax return you must be unmarried or considered unmarried by the IRS and live with a qualifying person that you can claim as a dependent such as a child or elderly parent for more than half of the year.

You must meet certain criteria to qualify as head of household. You can use a head of household calculator such as eFiles HOHucator Tool to determine if you meet these requirements. But to qualify you must meet specific criteria.

Supported a qualifying person. Unlike the rules for simply claiming a dependent qualifying as head of household requires that your dependent be closely related to you by birth or marriage. Youre unmarried or considered unmarried on the last day of 2020.

Your child or adopted child. To qualify for Head of Household status you must. Paid more than half the cost to run your or a qualifying parents home this year rent mortgage utilities etc and.

If you miss just one you need to file your tax return using single. Your child stepchild adopted child foster child brother sister or a descendant of one of these individuals whom you claim as a dependent under the qualifying children rules. Biological children stepchildren adopted children foster children.

As general rule state law. To qualify for head of household status a person must be unmarried or considered as if they were unmarried for the year.

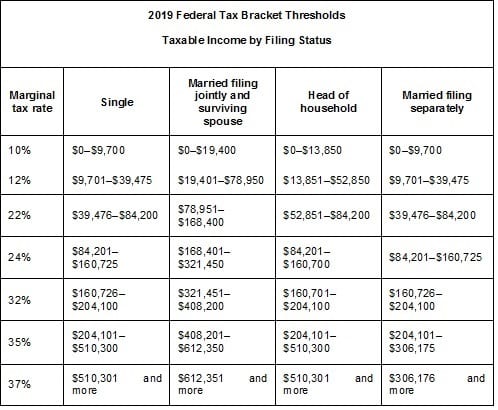

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

Better Brackets And Benefits When Filing As Head Of Household Fuoco Group

Better Brackets And Benefits When Filing As Head Of Household Fuoco Group

/two-heads-of-household-3193038_final-52aaf4f7fe1245ceaac454b66758f0ab.png) Can Two People Claim Head Of Household At Same Address

Can Two People Claim Head Of Household At Same Address

Fillable Online You May Qualify For Head Of Household Filing Status If You Meet The Following Three Tests Fax Email Print Pdffiller

Fillable Online You May Qualify For Head Of Household Filing Status If You Meet The Following Three Tests Fax Email Print Pdffiller

Difference Between Single And Head Of Household Compare The Difference Between Similar Terms

Difference Between Single And Head Of Household Compare The Difference Between Similar Terms

What Are The Basics Of The Head Of Household Tax Filing Status Purposeful Finance

What Are The Basics Of The Head Of Household Tax Filing Status Purposeful Finance

Learn How An Employee S Filing Status Affects Payroll

Learn How An Employee S Filing Status Affects Payroll

Taxes From A To Z 2020 H Is For Head Of Household Taxgirl

Taxes From A To Z 2020 H Is For Head Of Household Taxgirl

Head Of Household Definition Filing Requirements And Advantages

Head Of Household Definition Filing Requirements And Advantages

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png) How To File Your Taxes As Head Of Household

How To File Your Taxes As Head Of Household

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

Guide To Filing Taxes As Head Of Household Turbotax Tax Tips Videos

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 2014 07 The Health Care Assister Guide To Tax Rules Pdf

Filing As Head Of Household What To Know Credit Karma Tax

Filing As Head Of Household What To Know Credit Karma Tax

Head Of Household Filing Status Definition Rules 2020 Smartasset

Head Of Household Filing Status Definition Rules 2020 Smartasset

Comments

Post a Comment