However those purchasing a median-priced home today at about 350000 are still paying about 80 less than if they had bought a median-priced home of 315000 last year at. The year began with an already impressive rate.

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

An advantage of buying at a lower home price compared to having a lower interest rate is that your home can be refinanced or modified in the future.

Low interest rates and house prices. This can be an ideal environment for a hopeful home buyer but if youre struggling with unemployment due to a down economy you probably wont be able. Interest rate over the last 58 years. As well as making monthly mortgage payments more affordable low rates make houses more attractive because they depress the returns on alternative safe.

This is partially because not everyone buys real estate with a mortgage instead using cash and also due to macroeconomic factors. Interest rates can drive property prices in a variety of ways. Believe it or not both home prices and interest rates may rise in tandem.

Simultaneous low rates and low home prices can be indicative of a struggling economy. If interest rates are low but a home price is high it is possible that the overall cost of the mortgage will be lower than if interest rates were high but home prices were low. 226260 X 80 at 50 interest equals a payment of 97169.

The RBAs own modelling from a recent piece of internal research suggests that housing prices can rise as much as 10 per year with a 100 basis point reduction of the cash rate. During an economic downturn home prices may go down and the Federal Reserve might decide to lower interest rates to stimulate economic growth. The official cash rate has fallen 140 basis points since 2019 and doesnt seem likely to rise in 2021.

Given favorable homebuying demographics and historically low interest rates this tightness in inventory has caused home prices to rise faster than income harming housing affordability. However there are several additional factors that affect the total cost of the mortgage. As such the concern remains that the biggest result of the low interest rates and government stimulus is not jobs and economic growth but higher house prices.

Rates are now below 1945 levelsand well under 61 the average US. Indicated by 10-Year Treasury Yields a prime mover of interest rates As of September 28 2020 Source. In November of 2016 rates sunk to an all-time low down to 331 but four years later 2020 has it beat.

Over the last year interest rates have dropped from 21 to 09 a 65 decrease. The paper cites previous research by RBA economists that show a permanent percentage point reduction in official interest rates can drive up real house prices. Values across all capital cities jumped by at least 14 per cent as would-be homebuyers battled in a market where housing stock is low putting upward pressure on prices.

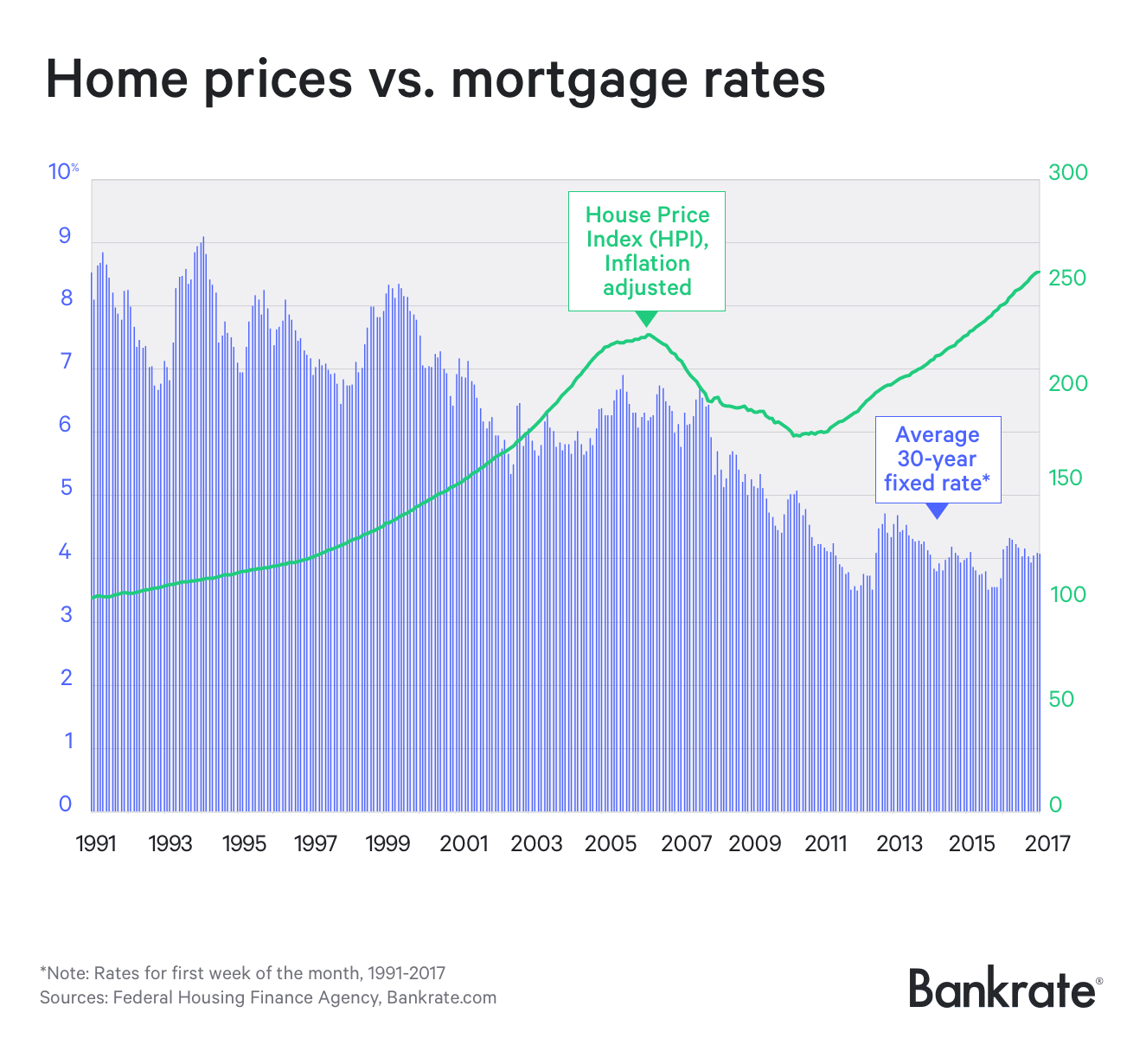

In fact mortgage interest rates and house prices have an inverse relationship. Heres how much home you could afford with rate fluctuations of 05. Very low interest rates introduced in response to Covid-19 have increased house prices creating capital gains for existing property owners and worsening the position of first-home.

Low interest rates expected to be held around 01 per cent for the next three years by the Reserve Bank are contributing to higher house prices. For context the average rate for a 30-year fixed mortgage spanning records from 1971 to the present day is roughly 8. Similar to the discounted cash flow analysis conducted on equity and bond investments the income approach takes the net cash flow.

The health of the economy can drive both higher or lower simultaneously. And a down payment of 20 of the sales price assuming you want to keep your payment principal and interest around 975. But low interest rates have a strong effect too.

240000 X 80 at 45 interest equals a payment of 97284. Or for interest rates to suddenly drop if home prices have increased. A mortgage interest rate can be affected by a concept called.

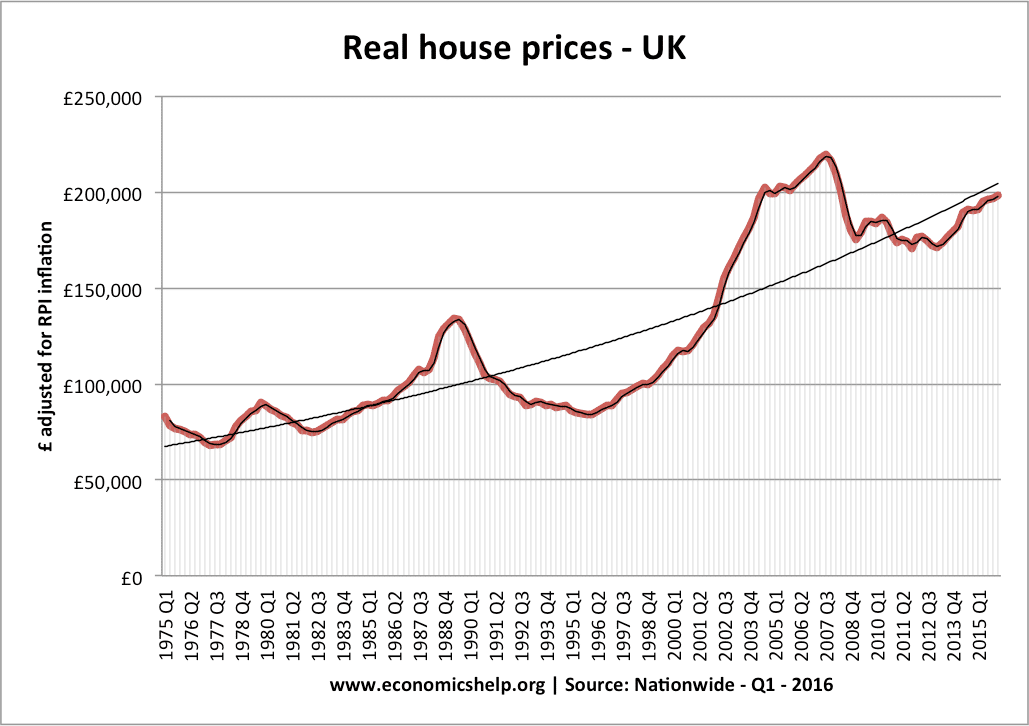

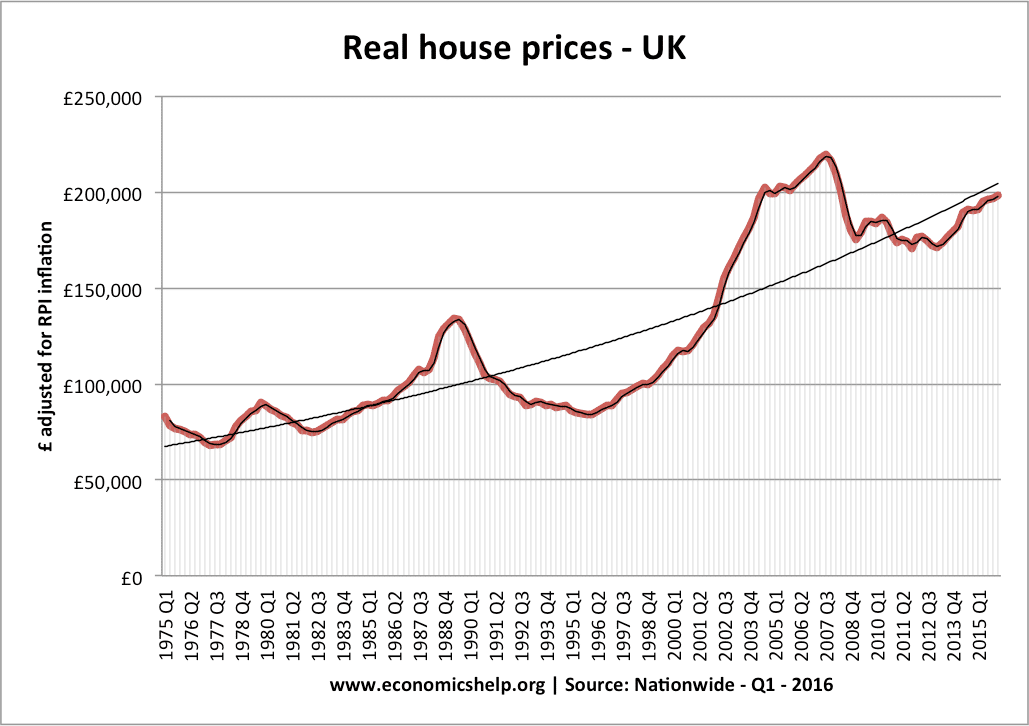

House Prices And Interest Rates Economics Help

House Prices And Interest Rates Economics Help

Housing Booms Capital Inflows And Low Interest Rates Vox Cepr Policy Portal

Housing Booms Capital Inflows And Low Interest Rates Vox Cepr Policy Portal

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

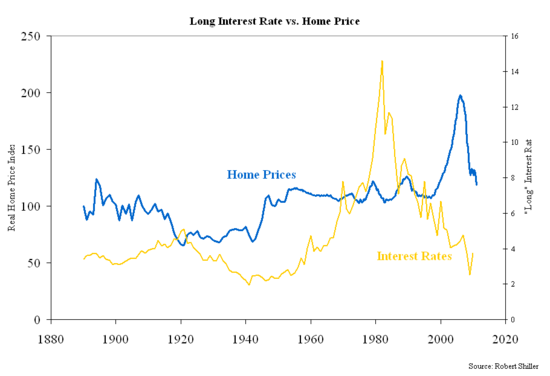

There S More To House Prices Than Interest Rates Bank Underground

There S More To House Prices Than Interest Rates Bank Underground

House Prices Vs Interest Rates Steve Saretsky

House Prices Vs Interest Rates Steve Saretsky

How Rising Interest Rates Affect Home Prices The Atlantic

How Rising Interest Rates Affect Home Prices The Atlantic

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

Do Rising Interest Rates Cause Property Prices To Fall Your Investment Property

Do Rising Interest Rates Cause Property Prices To Fall Your Investment Property

How Do Historically Low Interest Rates Affect Real Estate Prices Personal Finance Money Stack Exchange

How Do Historically Low Interest Rates Affect Real Estate Prices Personal Finance Money Stack Exchange

Bubble Or Boom Why Ultra Low Interest Rates Mean House Prices May Never Bust House Prices The Guardian

Bubble Or Boom Why Ultra Low Interest Rates Mean House Prices May Never Bust House Prices The Guardian

Low Interest Rates Steady Home Prices To Help Boost Indian Residential Market S P Global Market Intelligence

Low Interest Rates Steady Home Prices To Help Boost Indian Residential Market S P Global Market Intelligence

Do Rising Mortgage Rates Trigger Lower House Prices Bankrate Com

Do Rising Mortgage Rates Trigger Lower House Prices Bankrate Com

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

There S More To House Prices Than Interest Rates Bank Underground

There S More To House Prices Than Interest Rates Bank Underground

Comments

Post a Comment