For example a 100 deposit on a -25 balance would give you an account balance of 75. Opt in for overdraft protection Well automatically cover purchase transactions that exceed your available balance The amount of coverage is based on your direct deposits You have 24 hours from the authorization of the first transaction that overdraws your account to bring your account positive to avoid a 15 fee.

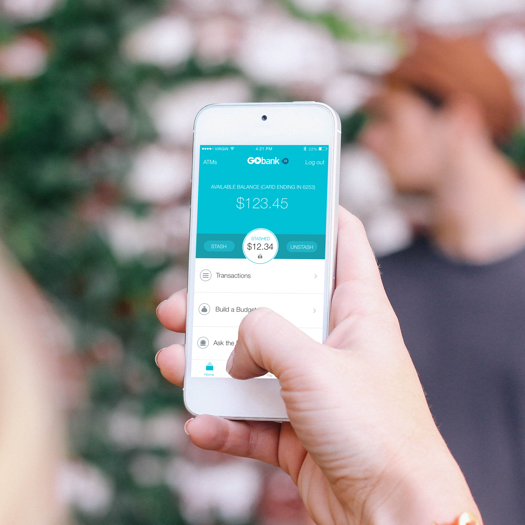

Gobank Review Early Direct Deposits Deposit Cash At Green Dot

Can my eligibility for overdraft protection change.

Gobank overdraft protection. Overdraft Protection To take advantage of up to 200 in overdraft protection customers got to make multiple direct deposits within a span of 35 days. More on GoBank overdraft. To take advantage of up to 200 in overdraft protection customers need to make multiple direct deposits within a span of 35 days.

Green Dot Bank GO2bank and Bonneville Bank. What fees are charged for overdraft protection. You must opt in to overdraft.

GoBank Member FDIC is an online-only bank that only offers a checking account. FDIC protection means that if the bank fails consumers will not lose their money. There are necessary amounts to stay under to ensure FDIC protection but GoBanks decision to limit consumers to no more than 50000 in their account means they are always fully covered by the FDIC.

For all GoBank accounts you must be at least 18 years of age. See Business Insiders list of checking accounts with early direct deposit GoBank is a brand of Green Dot Bank Member FDIC that provides an online-only checking account. What amount of overdraft protection coverage is provided.

How do I opt out of overdraft protection. Which transactions are eligible for fees. The bank would assess an overdraft charge and request that you deposit funds immediately to cover the 100.

Continue to site Back to TD Bank. GoBank also operates under the following registered trade names. You are now leaving our website and entering a third-party website over which we have no control.

If you opted in to overdraft protection the bank would still approve the debit purchase allowing you to complete your purchase. A 15 fee may apply. The GoBank Checking Account lets you receive your paycheck and government benefits early.

There are no other penalty fees to worry about but if you want to order paper checks itll set you back 595 for a pack of 12. After that the fee is 15. Cash deposits are limited to 2500 per day and 3000 per 30 days subject to a maximum account balance of 50000.

GoBank seems to offer quite a few benefits as a no-frills mobile banking service. GoBank doesnt charge overdraft fees since it doesnt offer an overdraft at all. Your first Monthly Membership fee will be automatically deducted from your account 30 days after you open an account.

The Up Side of GoBank. Payments for such overdrafts will be deducted from future deposits. Can I avoid fees for overdraft protection.

See you in a bit. Customers have 24 hours to cover their overdraft at no charge. However your account would at that point be overdrawnthat is youd have a negative account balance.

ATM withdrawals bill payments made within the app and sending money to others are not covered by overdraft protection. All of these registered trade names are used by and refer to a single FDIC-insured bank Green Dot Bank. Overdraft Protection GO2bank offers overdraft protection up to 200 if you set up direct deposits through which you can then opt in for overdraft protection.

Then the fee is 15. But if being able to overdraft is important to you there are a few other options you can look at. There are no overdraft.

The amount of overdraft coverage you receive is based on your direct deposits. Basic coverage receive 10 of coverage for any single direct deposit of any amount to your account. There are no overdraft fees but GoBank also doesnt provide overdraft protection.

Learn more about eligibility requirements here. Which transactions are covered by overdraft protection. There are three levels of overdraft protection.

If you have qualified for and unlocked Backup Balance there wont be any penalties if you overdraft your account by up to 100. Follow us on 888 288-1843. If your purchase would overdraw your account then GoBank simply denies it.

Additional levels of protection are available for those receiving 200 or more in direct deposits over a rolling 35-day period. GoBank is insured by the FDIC. GO2bank accountholders who receive direct deposit are eligible for Basic overdraft protection coverage.

Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. There are three levels of overdraft protection. Consider using another bank that will allow you to set up an overdraft protection product in particular banks with no overdraft fees.

Neither TD Bank US Holding Company nor its subsidiaries or affiliates is responsible for the content of the third-party sites hyperlinked from this page nor do they guarantee or endorse the information recommendations products or services. Overdraft protection helps cover purchase transactions that exceed your available balance. You must opt in to overdraft protection to be covered.

There are no fees for transactions of 5 or less and no fee for transactions that overdraft your account balance up to 10 with the Premium 100 and Premium 200 coverage levels of protection. Can I opt-out at any time. There are no fees for overdraft protection with the Basic coverage level.

Customers have 24 hours to hide their overdraft at no charge.

Not So Fast Citi Walmart Intros Gobank Checkless Accounts Atm Marketplace

Not So Fast Citi Walmart Intros Gobank Checkless Accounts Atm Marketplace

Gobank Review What You Need To Know About Gobank Fees Cards Deposits Advisoryhq

Gobank Review What You Need To Know About Gobank Fees Cards Deposits Advisoryhq

Go2bank Overdraft Protection When You Need It

Gobank Review Early Direct Deposits Deposit Cash At Green Dot

Go Bank Reviews Everything You Want To Know Review Of Gobank Com Advisoryhq

Go Bank Reviews Everything You Want To Know Review Of Gobank Com Advisoryhq

Gobank On Twitter Direct Deposit Your Tax Refund To Your Gobank Account Today Http T Co Oyieimadpw

Gobank On Twitter Direct Deposit Your Tax Refund To Your Gobank Account Today Http T Co Oyieimadpw

Online Checking Account Mobile Online Banking Gobank

Online Checking Account Mobile Online Banking Gobank

Green Dot Cash Back Mobile Account Debit Cards

Green Dot Cash Back Mobile Account Debit Cards

Uber Visa Debit Card Backup Balance Overdraft Protection Uber Driver Help

Uber Visa Debit Card Backup Balance Overdraft Protection Uber Driver Help

Go2bank Overdraft Protection When You Need It

Green Dot Launches The Unlimited Cash Back Bank Account To Help Americans Build Savings While They Spend Green Dot Corporation

Green Dot Launches The Unlimited Cash Back Bank Account To Help Americans Build Savings While They Spend Green Dot Corporation

:max_bytes(150000):strip_icc()/go-bank-0b7a0afce14e48ba9bed666fce5b6bc8.jpg)

Comments

Post a Comment