Donors in turn may be able to deduct their contributions to churches on their income tax return. Church Exemption Through a CentralParent Organization A church with a parent organization may wish to contact the parent to see if it has a group ruling.

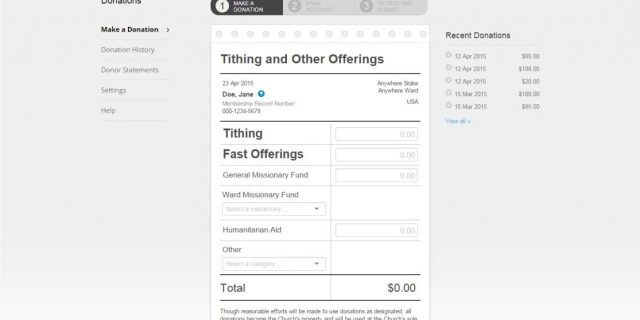

How To Print Your Official 2020 Tax Summary Statement Of Church Donations Lds365 Resources From The Church Latter Day Saints Worldwide

How To Print Your Official 2020 Tax Summary Statement Of Church Donations Lds365 Resources From The Church Latter Day Saints Worldwide

The Internal Revenue Service allows a person or business to claim federal tax deductions made from a church or other qualified charity.

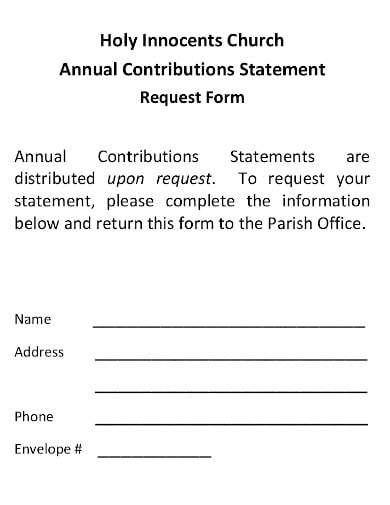

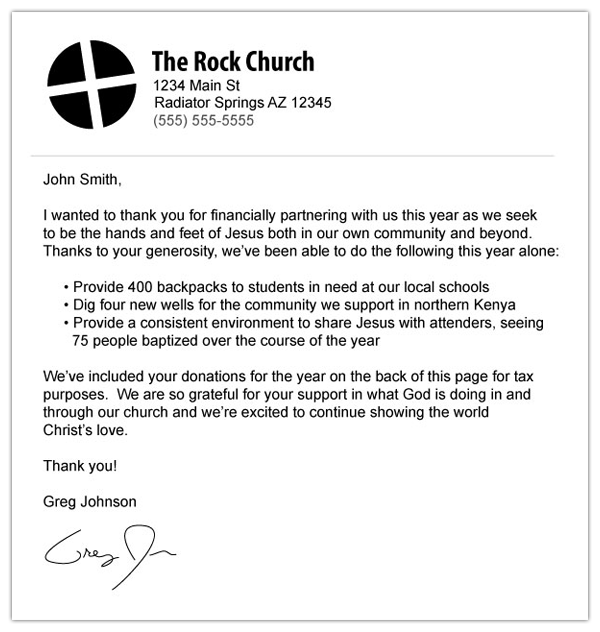

Tax statement for church contributions. Income Tax Donors may deduct contributions on tax returns timely acknowledgement required CTC is covered by Group Ruling All CTC churches covered by group ruling Churches may request a specific inclusion letter Questions. Dear personalize We thank God for you. Because of your contributions our congregation has been able to support the work of Jesus Christ locally regionally and around the world.

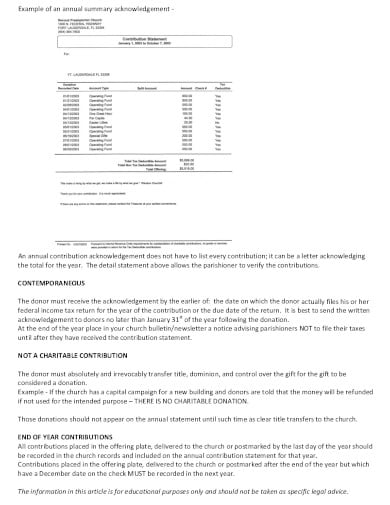

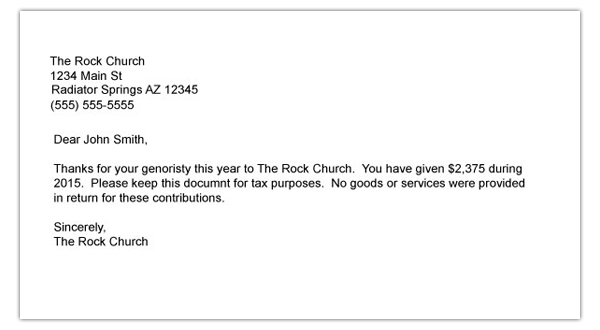

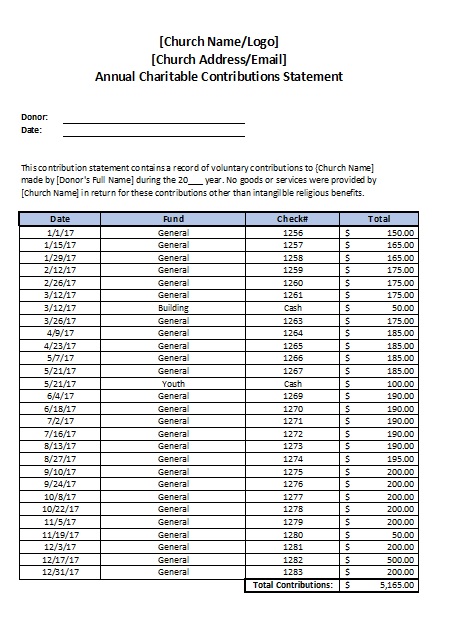

December 31 20____ Contribution Statement for the Year of 20____ Contributors Name_____ For the calendar year of 20____ our records indicate that you made the following cash contributions. No goods or services were provided by the church in return for the contribution Wording like this is essential for donors to report their contributions per the IRS. Should you have any questions about any amount reported or not reported on this statement please notify the church treasurer within 60 days of the date of this statement.

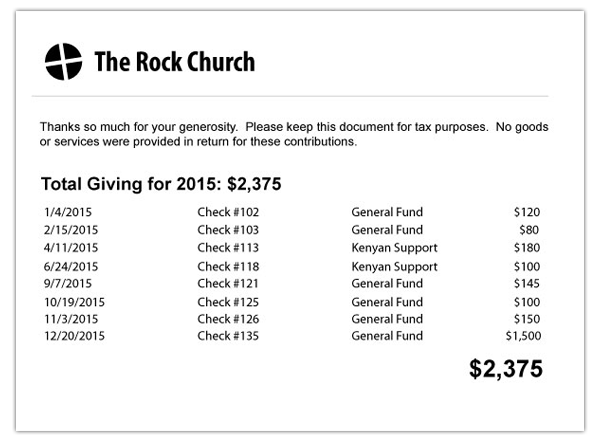

Official Task Statement or Statement of Contributions. You made these gifts out of your own generosity and commitment to Jesus Christ. The best way a church can help in this process is to give end-of-year contribution statements to their donors that include a declaration like the following.

The file is a highly compatible template that you can download and access in all kinds of portable devices. This Church Contribution Yearly Statement is a quite convenient way to format the church contribution income statement that you can send the donors. A giver will not.

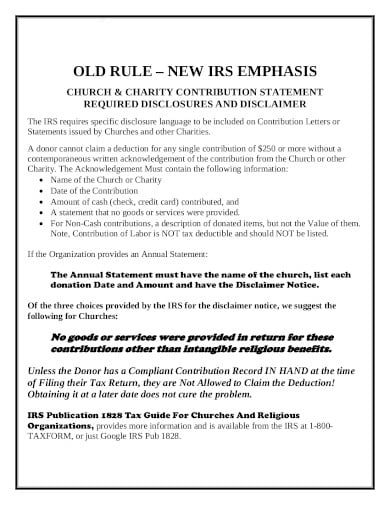

For noncash contributions please consult your tax specialist _____ Church. Lets do a rundown of the big changes you need to know about when making tax statements for church contributions. IRS Statement included in these letter for tax purposes - The IRS states you have to include this statement in your contribution letters - You did not receive any goods or services in return for any of these contributions other than intangible religious benefits.

The contribution can be cash or property. Then select which tax form you want to print. It must also contain a statement explaining whether the charity provided any goods or services to.

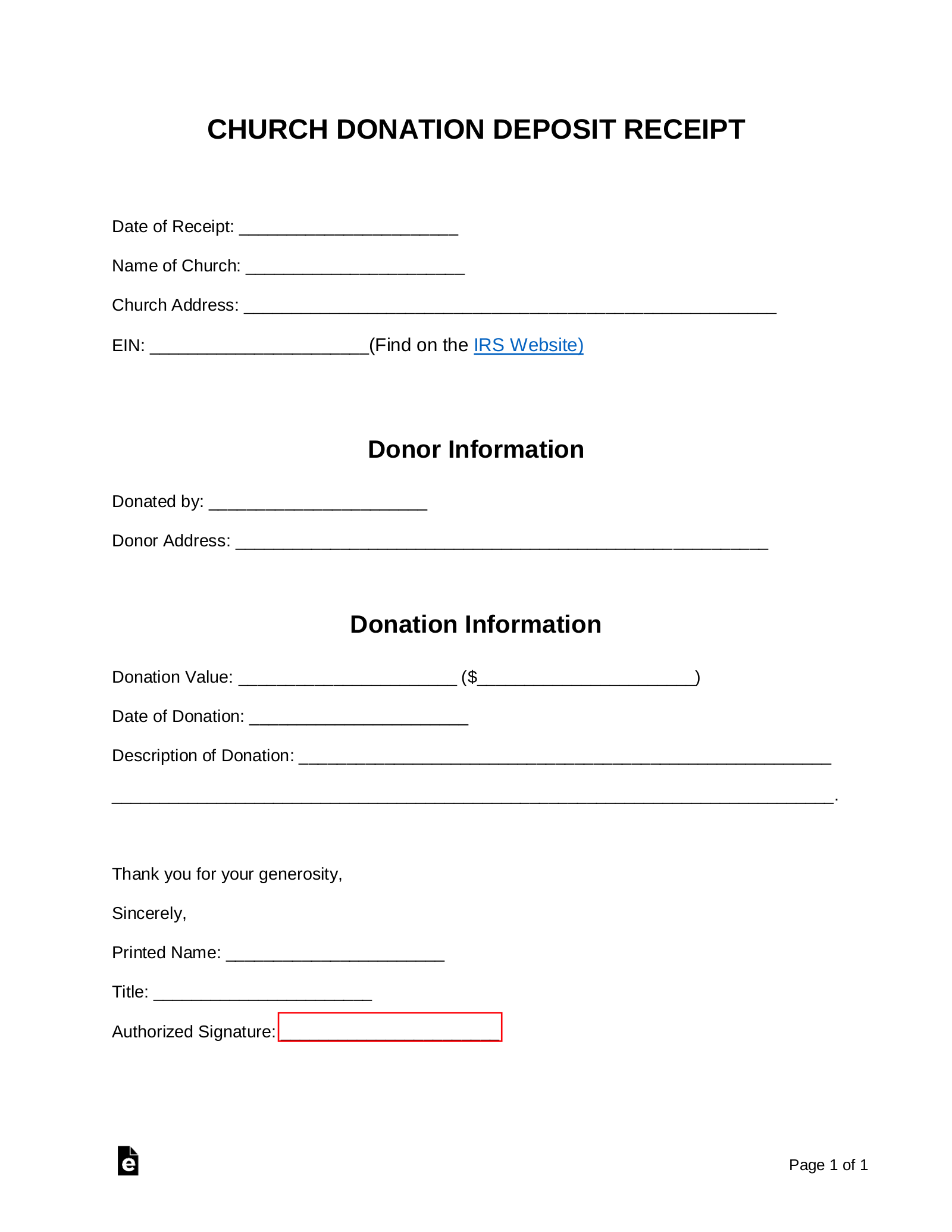

Church Name or Logo Church Address and Tax ID Number is optional but I did add it to the form below as many churches do. This applies to all cash donations of up to 300 made before Dec. Enclosed you will find your record of giving during the past year of 2020.

Requirements for a Contribution Receipt. If you see any discrepancies at all get in touch with us as soon as possible. As tax exempt organizations churches are qualified by the Internal Revenue Service IRS to receive contributions from donors.

Since qualified churches are not subject to federal income tax these donations are tax-free to the church. Contribution Letter for Taxes 2020. Under the group exemption.

The IRS can fine a church for deliberately issuing a false acknowledgment to a contributor. It is the best way to have a comprehensive layout with suggestive content that will enable you to make a difference. If the parent holds a group ruling then the IRS may already recognize the church as tax exempt.

Title of Report or Statement Donors Name s Donors Address Listing of Each Donation Include. The fine is up to 1000 if the giver is an individual and 10000 if the giver is a corporation. The itemized statement for your members donations should include the following.

So now we will talk about tax deductions for church donations. A breakdown is needed for charitable deductions or to claim a church deduction on federal taxes. Individuals seeking a federal income tax charitable contribution deduction must produce upon request a written receipt from the church if a single contributions value is 250 or more.

Your gifts to _____Church throughout year are gratefully acknowledged. Carefully examine this record and compare it with your records. Example of an Annual Contribution Statement.

The IRS has introduced a new tax provision that allows taxpayers to deduct up to 300 in donations given to qualifying charities during 2020. The receipt must include the Churchs or Nonprofits name the donors name the date s of the donation s and the amount s. Statement that goods or services if any that the organization provided in return for the contribution consisted entirely of intangible religious benefits if that was the case.

In addition a donor may claim a deduction for contributions of cash check or other monetary gifts only if the donor maintains certain written records. Recognized as tax exempt would know that their contributions generally are tax-deductible. In order to take advantage of these.

Lesson 39 How To Create A Year End Donor Summary Statement In Quickbooks Church Accounting Software Guide

Donation Form For Tax Purposes Inspirational Donation Receipt Letter For Tax Purposes Templa Donation Letter Mission Trip Fundraising Letter Fundraising Letter

Donation Form For Tax Purposes Inspirational Donation Receipt Letter For Tax Purposes Templa Donation Letter Mission Trip Fundraising Letter Fundraising Letter

Https Www Wtplaw Com Sitefiles News Giving 20statements Pdf

10 Church Contribution Statement Templates In Pdf Free Premium Templates

10 Church Contribution Statement Templates In Pdf Free Premium Templates

10 Church Contribution Statement Templates In Pdf Free Premium Templates

10 Church Contribution Statement Templates In Pdf Free Premium Templates

How To Make An Awesome Or Terrible End Of Year Donation Receipt

How To Make An Awesome Or Terrible End Of Year Donation Receipt

Church Accounting Book Church Accounting Software Guide Part 15

Free Church Donation Receipt Word Pdf Eforms

Free Church Donation Receipt Word Pdf Eforms

Church Contribution Statement Fill Online Printable Fillable Blank Pdffiller

Church Contribution Statement Fill Online Printable Fillable Blank Pdffiller

Maximize Your Church S Giving Statements In 5 Easy Steps

Maximize Your Church S Giving Statements In 5 Easy Steps

10 Church Contribution Statement Templates In Pdf Free Premium Templates

10 Church Contribution Statement Templates In Pdf Free Premium Templates

How To Make An Awesome Or Terrible End Of Year Donation Receipt

How To Make An Awesome Or Terrible End Of Year Donation Receipt

How To Make An Awesome Or Terrible End Of Year Donation Receipt

How To Make An Awesome Or Terrible End Of Year Donation Receipt

Comments

Post a Comment