Therefore if your business has accepted or will accept. Select the either link Business Entity Search Certificate of Status Document Order Enter the name of the business or department ID number.

How To Get A Certificate Of Status In Maryland Online

How To Get A Certificate Of Status In Maryland Online

Maryland Business Express provides you with the resources to start a business in Maryland.

Maryland business status. Traditionally many companies used the funds to offset travel expenses related to international marketing but the funds can be applied for other marketing initiatives ranging from website development to fees for shipping sample products. Perform a free Maryland public business license search including business registries entity searches permit searches and business lookups. Be aware that bond exempt businesses are prohibited from collecting or accepting more than three 3 months of payment in advance for any memberships and from collecting or accepting more than 20000 in initiation fees.

Every time you purchase taxable tangible goods from businesses outside of Maryland whether in person over the phone or on the Internet the purchase is subject to Marylands 6 percent use tax or 9 percent alcoholic beverage tax if you use the merchandise in Maryland. In order to maintain Good Standing status it is important that you file required annual reports and maintain compliance with any applicable Maryland laws. See the status and the publicly available records pertaining to any registered business entity by using the SDAT Business search.

Marylands use tax protects Maryland businesses from unfair competition. The Maryland Business License Search links below open in a new window and take you to third party websites that provide access to MD public records. You can find information on any corporation or business entity in Maryland or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

Determine if a name is available in Maryland Search for business entity filings made with. This section supplies the latest information for business taxpayers. For businesses struggling to make business-related tax payments due to COVID-19 closures and restrictions they should email taxpayerreliefmarylandtaxesgov.

This website combines information previously spread across many state agencies into one easy-to-navigate site while also providing a clear outline of the steps involved in starting a business. More your business establish tax accounts file personal property returns register a trade name and order copies of business documents previously filed. Send all other returns payments and other correspondence regarding your personal or business tax accounts to.

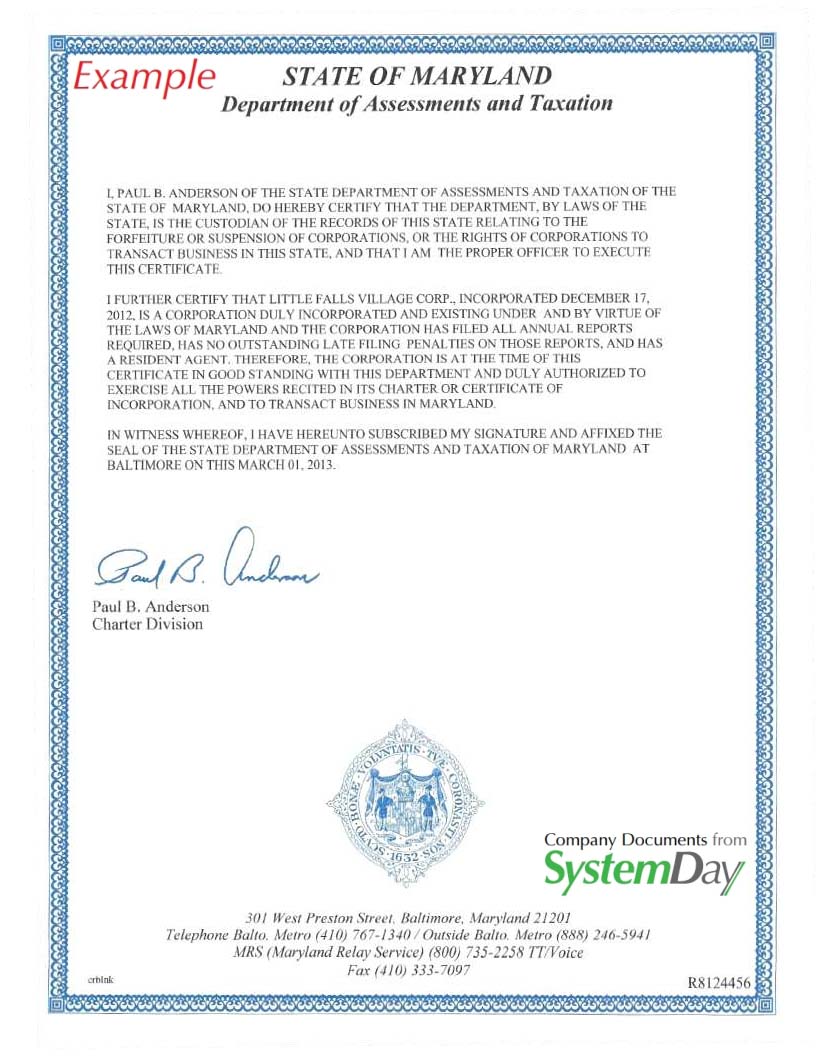

This site is not affiliated with any government entity and there is no charge to use it. Local businesses would be at a competitive. The Maryland State Department of Assessments and Taxation SDAT is encouraging business owners to look up their business status on Maryland Business Express to ensure they are in Good Standing with the state and if not to follow the steps in this Good Standing Checklist to avoid being forfeited.

Keep your business in Good Standing by completing the required annual filings. Use the links below to jump straight to the correct search page for Maryland or find the page for another state. For Filing and Business Related Questions Maryland Department of Assessments Taxation 410-767-1184 Outside the Baltimore Metro Area.

The Maryland Department of Assessments and Taxation Order Certificate of Status and other documents Less. A forfeited entity may not legally conduct business in the state. For more details please read our tax alert.

Failing to do so means your entity may be Not in Good Standing which eventually leads to forfeiture. ExportMD grants offer Maryland small and mid-sized businesses up to 5000 in reimbursement for expenses associated with an international marketing project. The following instructions provide information on how to convert a business registration status from bonded to bond-exempt status.

The State of Maryland pledges to provide constituents businesses customers and stakeholders with friendly and courteous timely and responsive accurate and consistent accessible and convenient and truthful and transparent services. Comptroller of Maryland Payment Processing PO Box 8888 Annapolis MD 21401-8888. The state income tax filing deadline has been extended until July 15 2021.

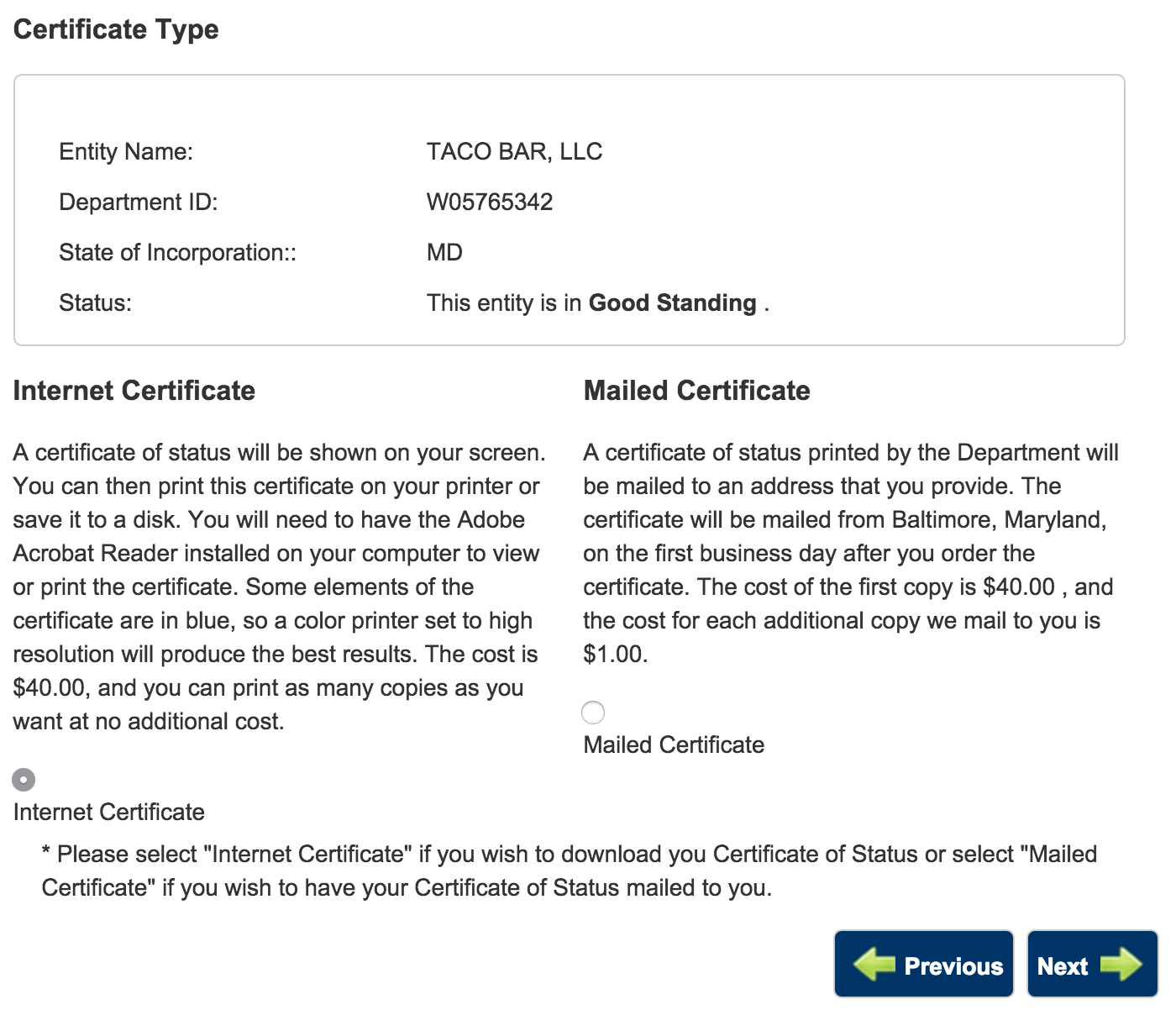

Business Entity Search Certificate of Status Document Order. Maryland Business Express - The Maryland Business Express site makes it easier for business owners and entrepreneurs to plan start manage and grow their business. Comptroller of Maryland Revenue Administration Division PO Box 549 Annapolis MD 21411-0001.

You can obtain a certificate for a business entity registered with the Department by going to the Maryland Business Express website at httpsegovmarylandgovbusinessexpress.

Maryland Business Entity Search Corporation Llc

Maryland Business Entity Search Corporation Llc

Https Dat Maryland Gov Businesses Documents Entitystatus Pdf

Maintain Good Standing Status Maryland Business Express Mbe

Maintain Good Standing Status Maryland Business Express Mbe

Maryland Certificate Of Good Standing Certificate Of Existence

Maryland Certificate Of Good Standing Certificate Of Existence

Maryland Business Entity Search Corporation Llc

Maryland Business Entity Search Corporation Llc

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

Maintain Good Standing Status Maryland Business Express Mbe

Maryland Certificate Of Good Standing Certificate Of Status Harbor Compliance

Maryland Certificate Of Good Standing Certificate Of Status Harbor Compliance

Maryland Secretary Of State Md Sos Business Search Secretary Of State Corporation Search

Maryland Secretary Of State Md Sos Business Search Secretary Of State Corporation Search

Maryland Good Standing Certificate Online Corporate Docs Inc

Maryland Good Standing Certificate Online Corporate Docs Inc

Maryland Good Standing Certificate Md Certificate Of Existence

Maryland Good Standing Certificate Md Certificate Of Existence

Maryland Business Entity Search Llc Corporation Partnership

Maryland Business Entity Search Llc Corporation Partnership

Maintain Good Standing Status Maryland Business Express Mbe

Maintain Good Standing Status Maryland Business Express Mbe

How To Search Available Business Names In Maryland Startingyourbusiness Com

How To Search Available Business Names In Maryland Startingyourbusiness Com

Comments

Post a Comment