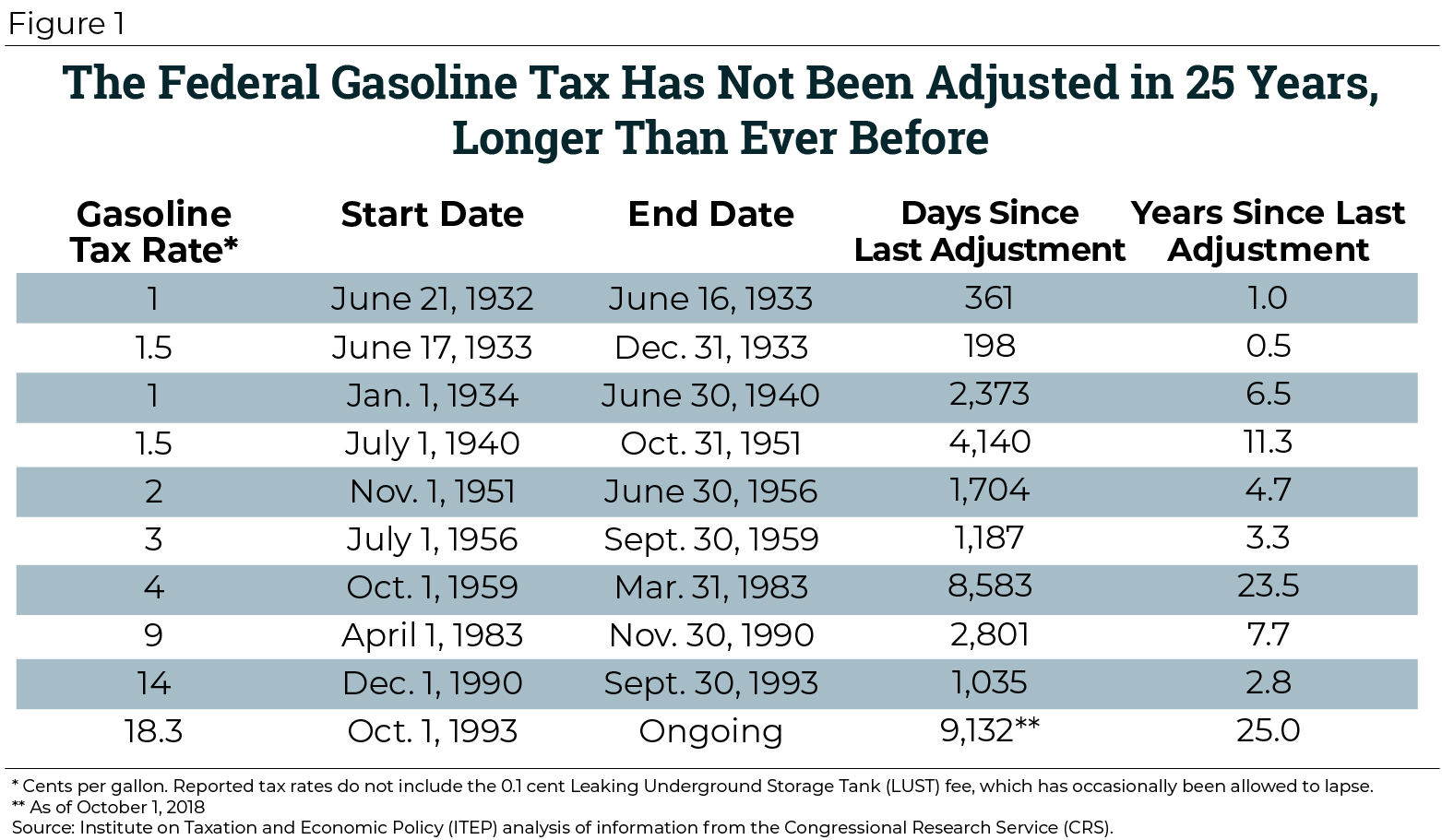

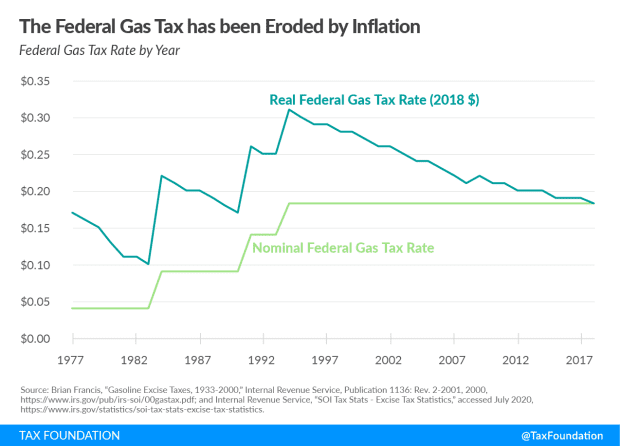

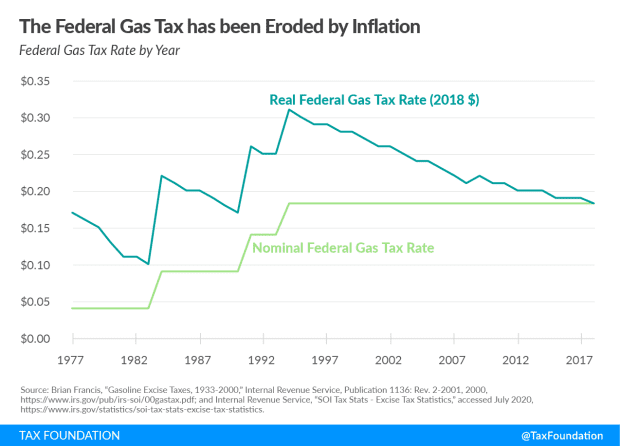

It has increased 10 times since President Herbert Hoover authorized the creation of such a tax to balance the budgetDrivers now pay 184 cents a gallon in the federal gas tax. 1 2 The federal tax was last raised October 1 1993 and is not indexed to inflation which increased by a total of 77 percent from 1993 until 2020.

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Every state adds its own tax to every gallon sold in the state too.

Federal fuel tax. 52 rows The current federal motor fuel tax rates are. Use Form 4136 to claim a credit for certain nontaxable uses of fuel the alternative fuel credit and a credit for blending a diesel-water fuel emulsion. For information on fuel credits against income tax see the instructions for Form 4136 Credit for Federal Tax Paid on Fuels Form 6478 Biofuel Producer Credit and Form 8864 Biodiesel and Renewable Diesel Fuels Credit.

In general the Internal Revenue Code imposes a federal fuel tax at the retail level on any liquid other than gasoline. Similar to gasoline a 01 cent per gallon fee is. The rate was raised 10 times between 1933 and 1993 but has seen no increase since then.

Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file. The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel. The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types.

API collects motor fuel tax information for all 50 states and compiles a report and chart detailing changes and calculating a nationwide average. This report is updated quarterly. 51 rows In the United States the federal motor fuel tax rates are.

The federal tax at 184 cents per gallon is meant to help the federal government pay to build and fix things like highways and bridges. Here is a summary report on gasoline and diesel taxes. The federal gas tax is currently 184 cents per gallon according to the Tax Policy Center.

2 A 01 cents per gallon tax is also levied on top of these fuel tax rates to help fund. 23 rows Table 2 Rates of fuel charge for Nunavut and Yukon. The federal government charges an excise tax at a flat rate of 10 cents per litre on gasoline in effect at that rate since 1995 and 4 cents per litre on diesel in effect at that rate since 1987.

Filing an exemption certificate for relief of the fuel charge. The federal gasoline excise tax is 184 cents per gallon as of 2020. What Is the Fuel Tax Credit.

State taxes include rates of general application including but not limited to excise taxes environmental taxes special taxes and inspection fees but they exclude state taxes based on gross. It also covers fuel tax credits and refunds. Federal taxes include excises taxes of 183 cents per gallon on gasoline and 243 cents per gallon on diesel fuel and a Leaking Underground Storage Tank fee of 01 cents per gallon on both fuels.

The gas tax was first imposed by the federal government in 1932 at a mere 1 cent per gallon. Charge on fuel held in a listed province on adjustment day Who has to pay a charge on fuel held in a listed province on adjustment day exceptions to the charge and how to file the return. Buttigieg later questioned whether raising gas taxes would be effective in the long term given the projected trend towards renewable energy.

The federal tax rate on diesel fuel is 243 cents per gallon. APIs chart reflects a weighted average for each state meaning that any taxes which can vary across a states. This tax pays for infrastructure projects and mass transportation costs and it includes a 01 cent per gallon fee that goes to the Leaking Underground Storage Tank trust fund.

The federal government levies an excise tax on various motor fuels intended for highway use1 Under current law the tax rate is 183 cents per gallon on gasoline and 243 cents per gallon on diesel fuel. Type July 1 2019 to. There are different types of taxes on transportation and heating fuel.

However the federal gas tax has been stuck in neutral since 1993 which is the last time the tax was increased.

Motor Fuels Taxes Diesel Technology Forum

Motor Fuels Taxes Diesel Technology Forum

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

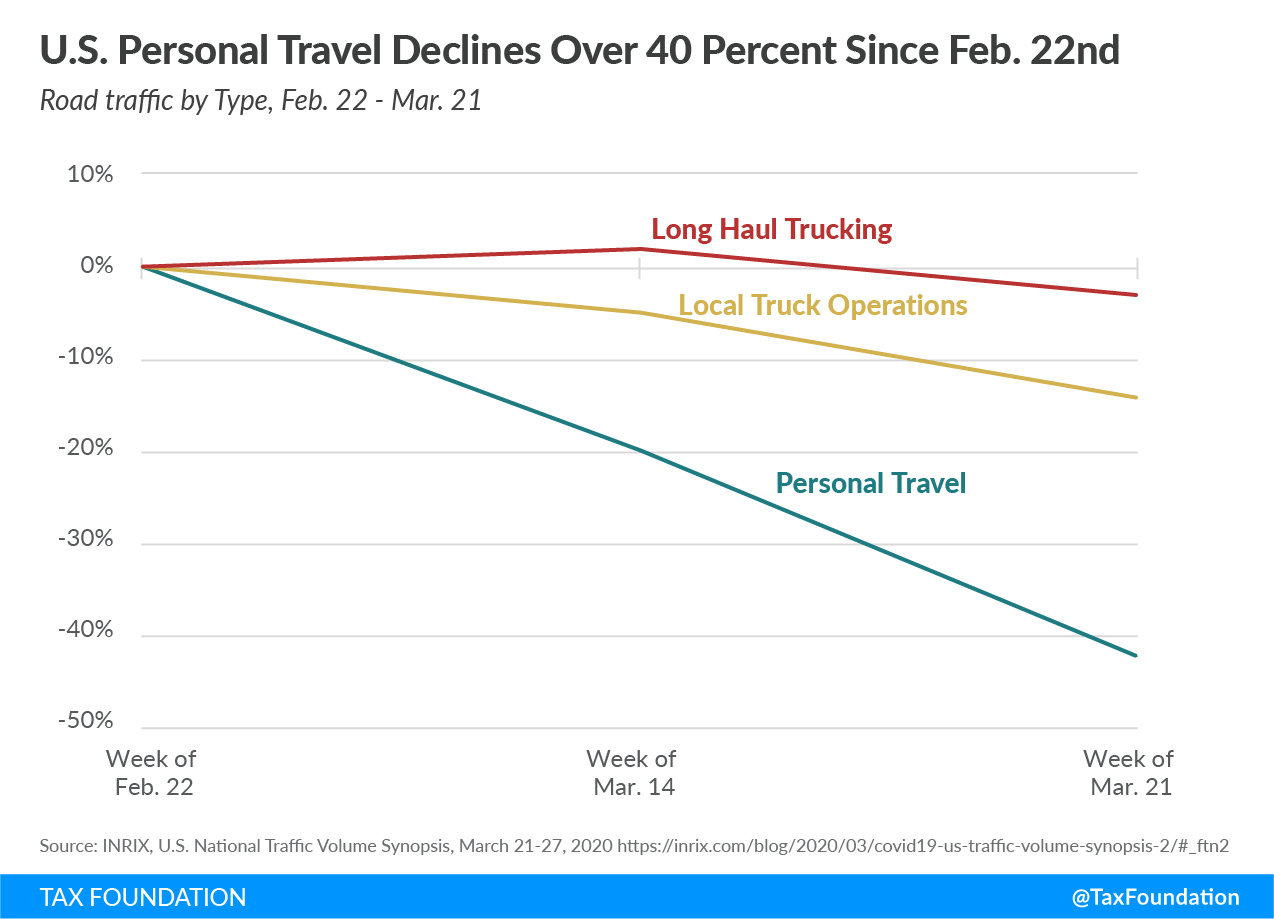

Gas Tax Revenue To Decline As Traffic Drops 38 Percent

Gas Tax Revenue To Decline As Traffic Drops 38 Percent

Hosed At The Pump Illinois Gas Taxes

Federal Excise Tax Rate On Gasoline Ff 02 17 2020 Tax Policy Center

Federal Excise Tax Rate On Gasoline Ff 02 17 2020 Tax Policy Center

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

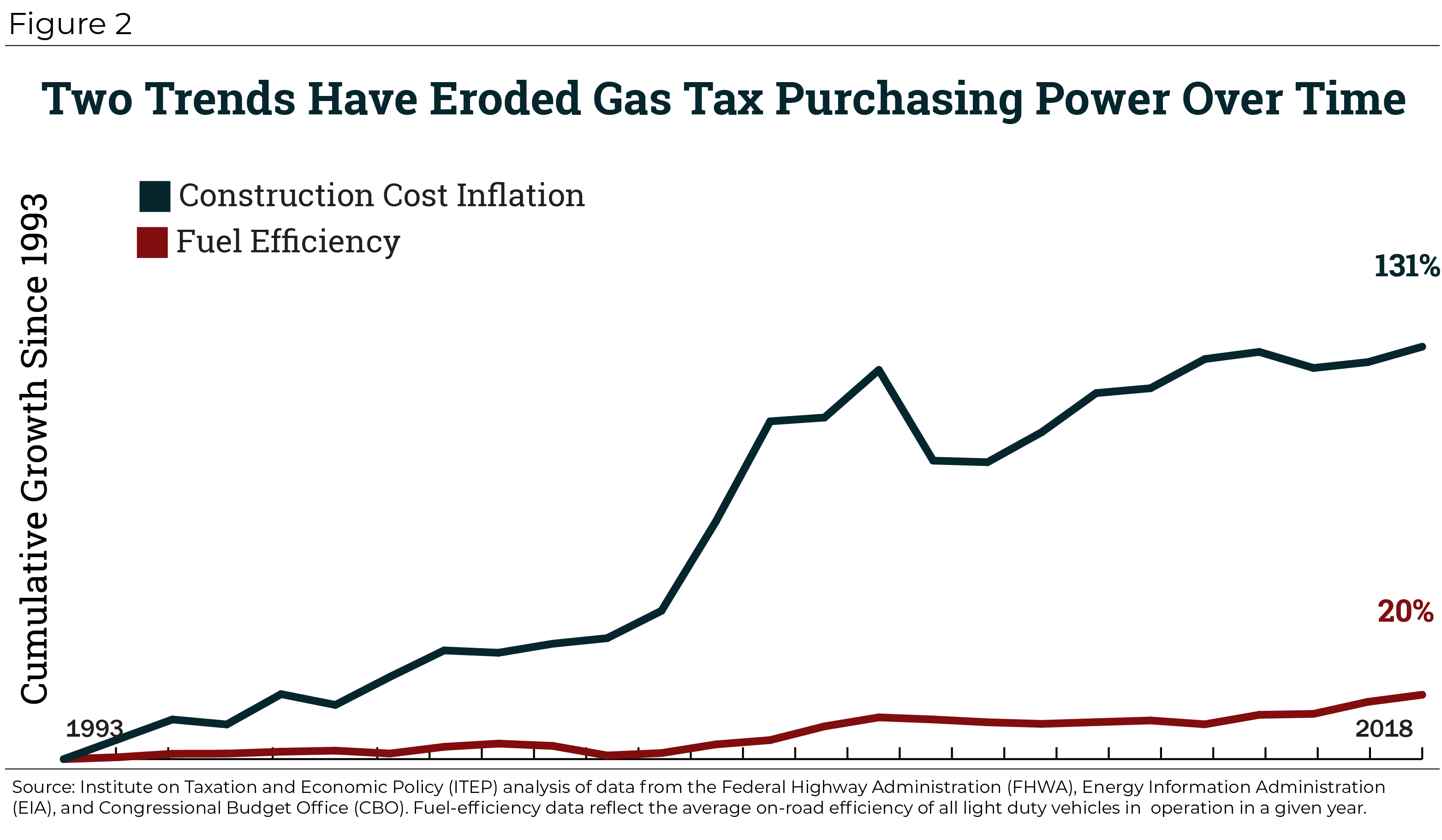

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

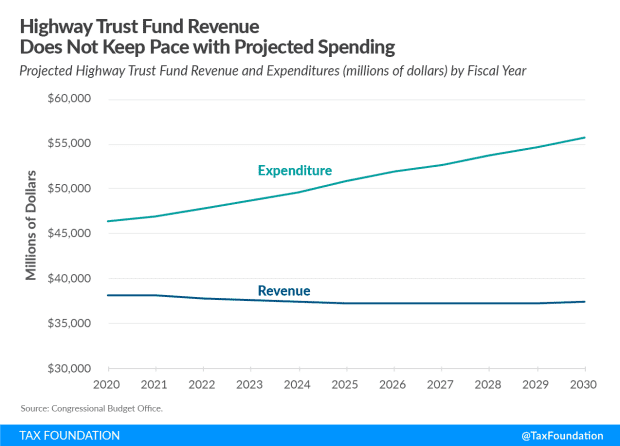

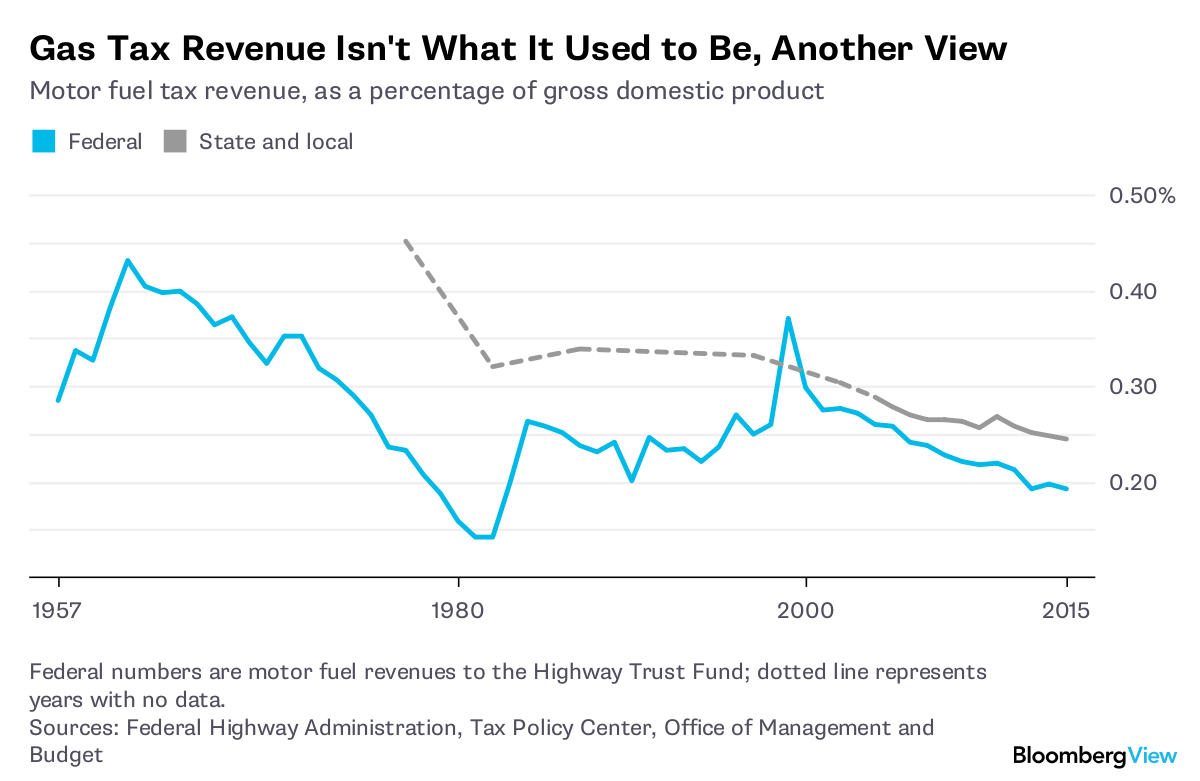

Gas Taxes Aren T Paying The Bills For Roads Anymore Bloomberg

Gas Taxes Aren T Paying The Bills For Roads Anymore Bloomberg

When You Buy A Gallon Of Gas How Much Of The Price Is Tax Quora

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

Failure To Keep Up Gasoline Taxes Has Crippled Highway Construction An Economic Sense

Failure To Keep Up Gasoline Taxes Has Crippled Highway Construction An Economic Sense

Comments

Post a Comment