Maryland Tax Alert 31121. Using our Maryland Salary Tax Calculator.

Maryland Income Tax Laws And Regulations Lexisnexis Store

Maryland Income Tax Laws And Regulations Lexisnexis Store

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Md income tax. We can be reached at 410-260-7980 from Central Maryland or at 1-800-MD-TAXES from elsewhere. The state income tax filing deadline for Marylanders has been extended by three months to July 15 2021. For assistance users may contact the Taxpayer Service Section Monday through Friday from 830 am until 430 pm by calling 410-260-7980 from central Maryland or 1-800-MDTAXES 1-800-638-2937 from elsewhere.

Instructions for filing personal income tax returns for nonresident individuals. Beginning February 1 2021 through April 15 2021 the Comptroller of Maryland has telephone assistance available to answer Personal Income Tax questions. Welcome to the Comptroller of Marylands Internet tax filing system.

To use our Maryland Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Marylands Withholding Requirements for Sales or Transfers of Real Property. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Maryland Income Tax Calculator - If you are looking for an efficient way to prepare your taxes then try our convenient online service. Maryland Comptroller Peter VR. Instructions for filing fiduciary income tax returns.

Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. Franchot D on Thursday announced that he is extending the state income tax filing deadline by three months until July 15 2021. Maryland Tax Forms for Nonresidents.

Additionally there is a statewide income tax in Maryland with a top rate of 575. For assistance users may contact the Taxpayer Services Division Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or via phone 410-260-7980 from central Maryland or at 1-800-MDTAXES 1-800-638-2937 from elsewhere. The three-month extension is the most generous tax filing and payment.

Maryland Instructions for Fiduciaries. Tax Information for Individual Income Tax For tax year 2020 Marylands personal tax rates begin at 2 on the first 1000 of taxable income and increase up to a maximum of 575 on incomes exceeding 250000 or 300000 for taxpayers filing jointly heads of. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs.

This system allows online electronic filing of resident personal income tax returns along with the most commonly associated schedules and forms. 2020 Tax Filing Season RELIEF Act. If you filed a joint return please enter the first Social Security number shown on your return.

Assistance is available from 830am to 700pm Monday through Friday except on State Holidays. No interest or penalties will be assessed if. No interest or penalties will be assessed as long as returns are filed and taxes owed are paid by the new deadline.

Preparacion de Income Tax Personales y de Negocios Corporaciones Non Profit Corp Contabilidad y Payroll y Payroll. Specifically counties in Maryland collect income taxes with rates ranging from 225 to 320. A nonresident individual is subject to tax on that portion of the federal adjusted gross income that is derived from tangible property real or personal permanently located in Maryland whether received directly or from a fiduciary and on income from a business trade profession or occupation carried on in Maryland and on all gambling winnings derived from Maryland sources.

You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of your refund as shown on the tax return you submitted. Updated 2020 Forms are Now Available. Enter this information in the boxes below.

May 14 2021 Comptroller Peter Franchot is reminding taxpayers that Monday May 17 is the Internal Revenue Service IRS filing deadline for the 2020 tax year for federal individual income tax returnsMaryland tax filers however have until July 15 to submit their individual state tax returns. MD Income Tax Dallas. 19 Zeilen Maryland Personal Income Tax Credits for Individuals and Instructions.

File personal income taxes. In order to determine an accurate amount on how much tax. Maryland is among the states in which local governments levy their own taxes on personal income.

Furthermore the State of Maryland released a Tax Alert on 31121 which states that all individual corporate pass-through entity and fiduciary income tax returns that otherwise would have been due on varying dates between January 1 2021 and July 15 2021 inclusive are now due on or before July 15 2021. Or you may e-mail us at taxhelpmarylandtaxesgov.

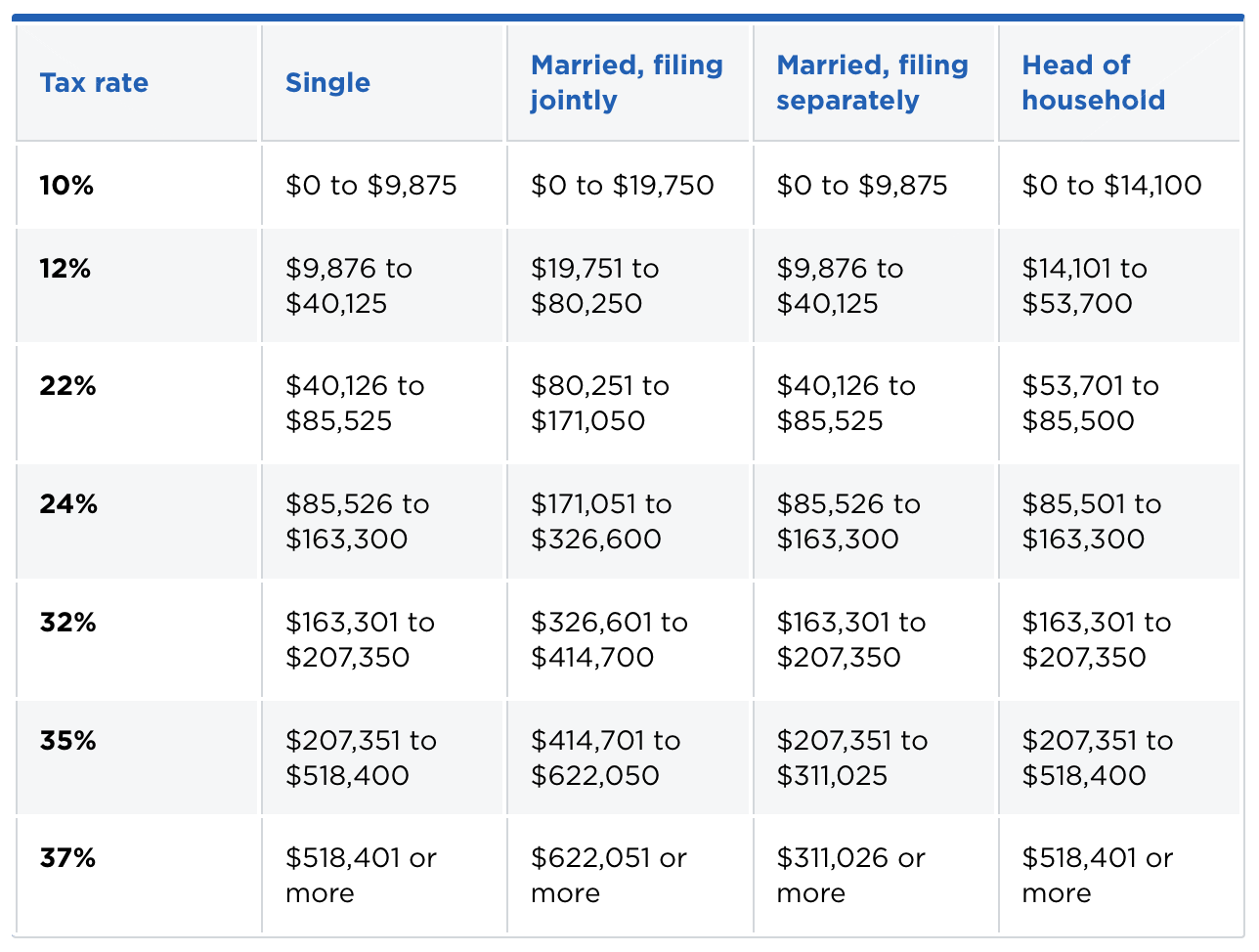

Tax Brackets 2020 Passive Income M D

Tax Brackets 2020 Passive Income M D

2019 State Individual Income Tax Rates And Brackets Tax Foundation

2019 State Individual Income Tax Rates And Brackets Tax Foundation

Https Www Marylandtaxes Gov Statepayroll Static Files 2021 Memos 2021 Maryland State And Local Income Tax Withholding Information Pdf

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

Maryland Considers Proposal To Extend Millionaires Tax To 100 000 Income Level Tax Foundation

Maryland Considers Proposal To Extend Millionaires Tax To 100 000 Income Level Tax Foundation

Low Earners Paying More In Taxes Than The Well Off In Maryland Maryland Center On Economic Policy

Maryland Tax Forms 2020 Printable State Md Form 502 And Md Form 502 Instructions

Maryland Tax Forms 2020 Printable State Md Form 502 And Md Form 502 Instructions

Maryland Income Tax Calculator Smartasset

Maryland Income Tax Calculator Smartasset

Comments

Post a Comment