Additionally the new reverse mortgage would need to provide a benefit of at least a 5x to you in cash benefit over the new closing costs. The Most Significant Reverse Mortgage Fees Are The Closing Costs.

Reverse Mortgage Closing Costs Fees Explained

Reverse Mortgage Closing Costs Fees Explained

Discover More About the Rates By Requesting a Quote Package From a Licensed Loan Advisor.

How much does it cost to get a reverse mortgage. Prices paid and comments from CostHelpers team of professional journalists and community of users. Lower cost than a lump sum payment because youll be paying interest and fees only on the money youve drawn so far. Term fixed monthly payouts for a set number of years or Tenure fixed monthly payouts as long as you maintain the reverse mortgage and the payout does not cause the balance to exceed the amount stated in the mortgage.

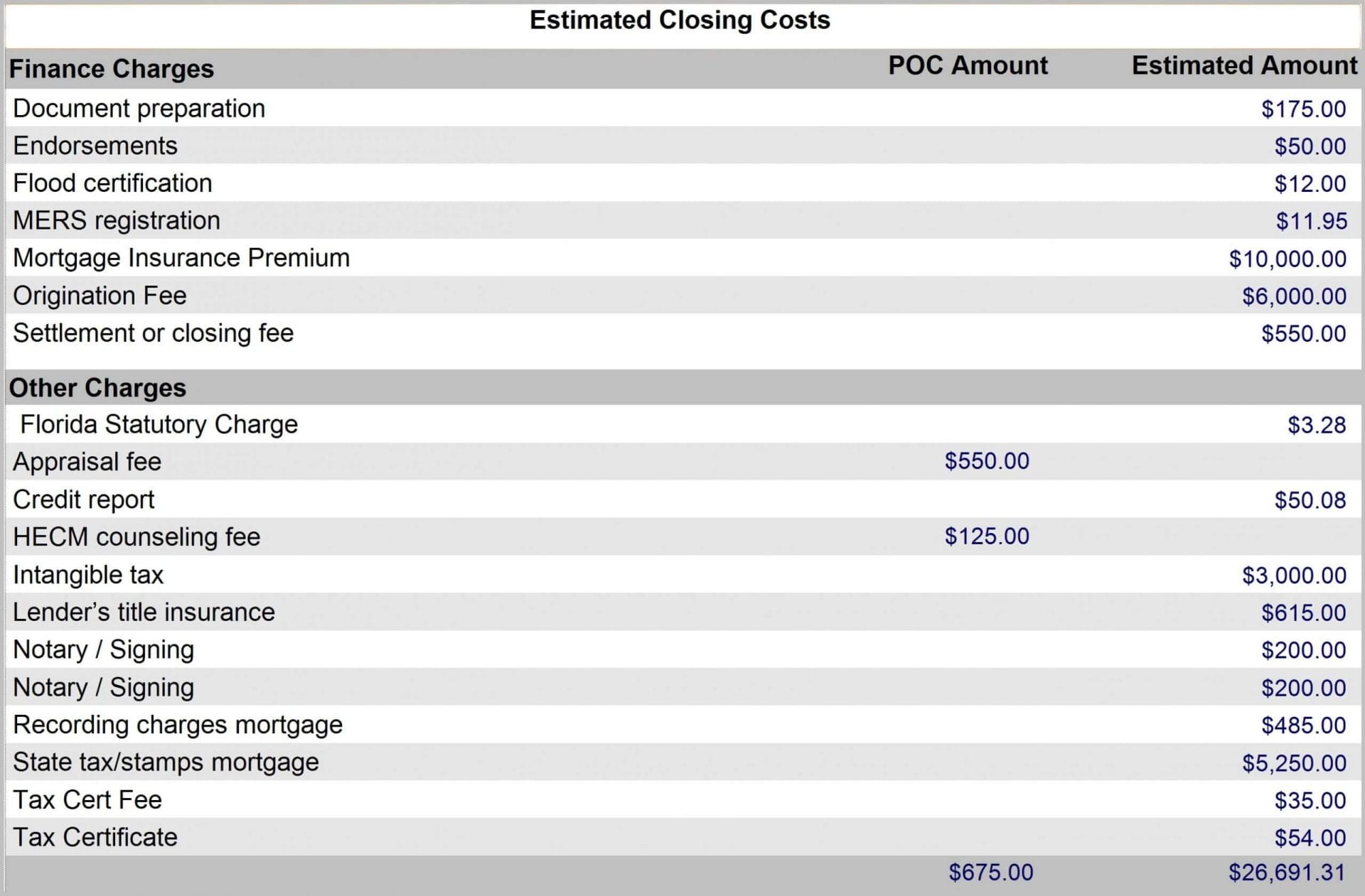

An upfront mortgage insurance premium which costs 2 of your homes value. Loan origination fee up to 6000. The reverse mortgage company will first cut a check to your current mortgage holder.

6 rânduri To originate a reverse mortgage lenders may charge an origination fee. That depends on your age home value the number of years you plan to occupy the property current interest rates and your loan costs. A reverse mortgage counseling fee which could cost 125 or more.

How Much Money Can I Get from a Reverse Mortgage. Eg if your HECM refinance closing costs are 5000 you would need to receive at least 25000 in available proceeds from the HECM finance at closing. Fees vary from lender to lender and are capped by the FHA.

Appraisers typically charge 100-150 for the follow-up visit. This will pay off your existing mortgage. Origination fee To process your HECM loan lenders charge the greater of 2500 or 2 percent of the first 200000 of your homes value plus 1 percent of.

Like with a traditional mortgage borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan. Generally taking a reverse mortgage is more expensive than other types of home loans. How much can you borrow with a reverse mortgage.

Almost All Closing Costs Are Financed Into The Loan Except The Required Counseling. As of 2018 the maximum amount anyone can be paid from a reverse mortgage is 679650. Appraisal fees vary throughout the country but the average price is 450 according to NRMLA National Reverse Mortgage Lenders Association.

Weve simplified the process with MoneyGeeks Reverse Mortgage Calculator. How much you can obtain on a reverse mortgage primarily depends on your age the value of your home and the current interest rate. Thats a lot to consider and the relationship between these multiple factors is complicated.

Typically you cannot use more than 80 percent of your home equity based on your appraised value. Yet that does not mean that you immediately get access to 120000. Take note of the following upfront costs.

The two major costs associated with the reverse mortgage are the mortgage insurance premium and the origination fee. As of 2018 the maximum amount that can be paid to anyone with a reverse mortgage is 679650. As a rule HECM total origination fees are capped at 6000.

Each equal to a charge of 2 on the homes value and the amount of the loan respectively. How much does a reverse mortgage pay. In general the.

Origination fees Lenders cannot charge over 2500 of the first 200000 of the homes value plus 1 of the amount over 200000. If the appraiser determines that repairs need to be made to the home they will need to make a second visit to verify the repairs. An annual mortgage insurance premium which costs 05 of your homes value.

For homes valued at 125000 or less the origination fee is capped at 2500. The more equity you have and the older you are the more you receive as your reverse mortgage proceeds. The origination fee covers your lenders operating expenses associated with originating your reverse mortgage.

The exact amount the reverse mortgage will pay you depends on a few different factors including your age the current home value and your interest rate. The amount of money you can borrow depends on the amount of home equity you have available. However most people will be paid much less.

You might qualify for a reverse mortgage loan of around 120000 after deducting all closing fees. A home appraisal and title search fee among other closing costs. How much a reverse mortgage should cost.

Origination fees which cannot exceed 6000 and are paid to the lender. Here is a lot of information about how a reverse mortgage works and how much you receive on a reverse mortgage.

True Costs Of A Reverse Mortgage Loan American Advisors Group

True Costs Of A Reverse Mortgage Loan American Advisors Group

Reverse Mortgage Costs In Canada Homeequity Bank

Reverse Mortgage Costs In Canada Homeequity Bank

True Costs Of A Reverse Mortgage Loan American Advisors Group

True Costs Of A Reverse Mortgage Loan American Advisors Group

What Is Home Equity Reverse Mortgage

What Is Home Equity Reverse Mortgage

9 Key Reverse Mortgage Questions Answered Lendingtree

9 Key Reverse Mortgage Questions Answered Lendingtree

Reverse Mortgage Problems Myths And Truths Homeequity Bank

Reverse Mortgage Problems Myths And Truths Homeequity Bank

What Is A Reverse Mortgage How Do They Work Millionacres

What Is A Reverse Mortgage How Do They Work Millionacres

Reverse Mortgages How They Work The Risks And

Reverse Mortgages How They Work The Risks And

Understanding The Closing Costs And Fees Of A Reverse Mortgage Loan

Understanding The Closing Costs And Fees Of A Reverse Mortgage Loan

6 Reverse Mortgage Disadvantages How To Avoid Them Reversemortgagereviews Org

6 Reverse Mortgage Disadvantages How To Avoid Them Reversemortgagereviews Org

Is A Reverse Mortgage Right For You Trusted Choice

Is A Reverse Mortgage Right For You Trusted Choice

What Happens To A Reverse Mortgage Loan When The Borrower Dies

Comments

Post a Comment