THE TERMS OF USE for the SDAT website prohibit any form of automatic or robotic data collection extraction or copying such as data mining or web scraping. See more of Maryland State Department of Assessments and Taxation on Facebook.

Maryland State Department Of Assessments And Taxation

Maryland State Department Of Assessments And Taxation

Violation of any Term of Use immediately terminates the users license or permission to access.

Maryland state tax and assessment. 1977 people follow this. If you are a Maryland resident you can file long Form 502 and 502B if your federal adjusted gross income is less than 100000. Ordering Certificates of Good Standing.

Senate Bill 1059 Chapter 347 Acts of 2009 changes the definition of a manufacturer to include cigarette makers that have plants located outside of the United States and those that sell cigarettes only to Maryland licensed wholesalers located outside of State boundaries. Maryland State Department of Assessments and Taxations Real Property Procedural Manual Last updated on December 3 2018 Table of Contents Category 001- Definitions Subject 001- Directives Topic 001 - Numbering Topic 002 - Publication of Procedures Subject 014 - Value Topic 001 - Market Disposition and Liquidation Category 004 - Owners. For more details please read our tax alert.

An appraisal is an estimate of value. Functions of the State Department of Assessments and Taxation began in 1878 when the office of the State Tax Commissioner was established by the General Assembly Chapter 178 Acts of 1878. We can be reached at 410-260-7980 from Central Maryland or at 1-800-MD-TAXES from elsewhere.

The tax levies are based on property assessments determined by the Maryland Department of Assessments and TaxationSDAT. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. Sdattalbmarylandgov Washington County Assessments 3 Public Square Hagerstown MD 21740.

The local income tax is calculated as a percentage of your taxable income. If you lived in Maryland only part of the year you must file Form 502. There are three accepted approaches to.

1723 people like this. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. There are 24 local State assessment offices one in each county and Baltimore City.

Since the Comptrollers Office does not process property tax. 34 This allows taxable property to be assessed uniformly state-wide and the department must establish a method of assessment that can be applied across all counties and Baltimore City alike. Marylands 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments.

Guide to searching the database. Local officials set the rates which. Users noting errors are urged to notify the Maryland Department of Planning Mapping 301 W.

Note tax rates are expressed as dollars per 100 of assessment. Property maps provided courtesy of the Maryland Department of Planning. Sdatstmmarylandgov Somerset County Assessments 11545 Somerset Avenue Princess Anne MD 21853 410 651-0868 410 651-1995.

Maryland pioneered in having the process of property assessment centralized at the state level. For individuals with questions regarding income tax return filings and payments they can email taxhelpmarylandtaxesgov. Sdatsommarylandgov Talbot County Assessments 29466 Pintail Drive Suite 12 Easton MD 21601 410 819-5920 410 822-0048.

All other business inquiries not listed above. Trade Name Applications and Renewals. Contact Maryland State Department of Assessments and Taxation on.

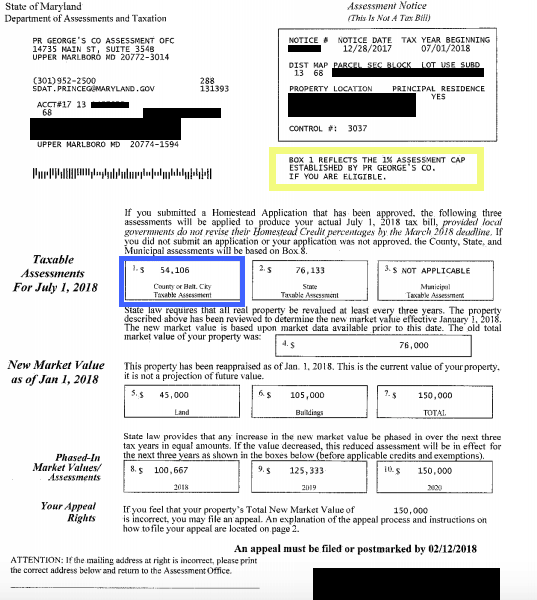

Each county and municipality annually sets its assessment cap between 0 and 10. Get Directions 410 767-1184. Phase-in Assessment 100 x Tax Rate Tax Bill These columns show the phase-in assessments for the current and next year.

Preston Street Baltimore MD 21201. 301 W Preston St 218867 mi Baltimore MD MD 21201. SDATPersPropMarylandgov for questions regarding Personal Property Tax Return The simplest and easiest method to file both the Annual Report and Personal Property Tax Return is through Maryland Business Express MBE SDATs award-winning platform for creating a business making annual filings and requesting document copies online.

Property Taxation in Maryland3 annual assessment increase above a specified cap The percentage cap on assessment increases is set at 10 for purposes of the State property tax. An assessment is based on an appraisal of the fair market value of the property. If you are a nonresident and need to amend your return you must file Form 505X.

Assessments are certified by the Department to local governments where they are converted into property tax bills by applying the appropriate property tax rates. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. The phase-in assessment is the amount to which the tax rate is multiplied to determine tax liability.

If you are a nonresident you must file Form 505 and Form 505NR. If a plat for a property is needed contact the local Land Records office where the property is located. Real Property Data Search.

It allows all manufacturers to obtain a license to sell cigarettes in Maryland and incorporates into the definition of manufacturer those. The state income tax filing deadline has been extended until July 15 2021. Note that if the property will be revalued before the next tax year starts NOT AVAIL will appear.

Maryland is the only state where the assessment process is centralized at the State level.

Maryland State Department Of Assessments Taxation

Maryland State Department Of Assessments Taxation

2018 Pg County Reassessment Notices

2018 Pg County Reassessment Notices

Maryland State Homestead Credit

Maryland Department Of Assessments And Taxation Anne Arundel County Public Library

Maryland Department Of Assessments And Taxation Anne Arundel County Public Library

Maryland Certificate Of Good Standing Certificate Of Status Harbor Compliance

Maryland Certificate Of Good Standing Certificate Of Status Harbor Compliance

Maryland State Department Of Assessments Taxation Origin Functions

Maryland State Department Of Assessments Taxation Origin Functions

How To Appeal Your Maryland Property Tax Assessment

How To Appeal Your Maryland Property Tax Assessment

Department Of Assessments And Taxation Maryland Onestop

Https Cdn Laruta Io App Uploads Sites 7 Legacyfiles Uploadedfiles Msba Member Groups Sections Taxation Study Groups Taxcontroslides101614 Pdf

Property Tax Assessments In Maryland Federal Title Escrow Company

Property Tax Assessments In Maryland Federal Title Escrow Company

Department Of Assessments And Taxation

Department Of Assessments And Taxation

Maryland State Department Of Assessments Taxation

Maryland State Department Of Assessments Taxation

Maryland Property Tax Assessment Appeals Boards

Comments

Post a Comment