Personal loan APRs through Prosper range from 795 to 3599 with the lowest rates for the most creditworthy borrowers. Prosper is a peer-to-peer lender that provides personal loans to borrowers with fair or good credit.

Prosper Loans 2021 Personal Loans Review P2p Lending Overview

Prosper Loans 2021 Personal Loans Review P2p Lending Overview

You need a FICO score of 640 or higher.

About prosper loans. It was found in 2005 in San Francisco California. Known as Prosper Healthcare Loans PHLs these specialty loans are available in amounts up to 35000 which are repayable over a period of up to 5 years. All loans have terms of three years or five years and are fixed rate fixed payment installment loans that will be paid in full at the end of the term.

Payoff loans offer similar loan amounts to Prosper 5000 to 35000 and are also designed for borrowers with less-than-perfect credit. Prosper is a peer-to-peer lending marketplace that has facilitated over 18 billion in loans since 2006. Prosper Loans is an online peer-to-peer lender marketplace that offers fast loans funded by individuals and investors.

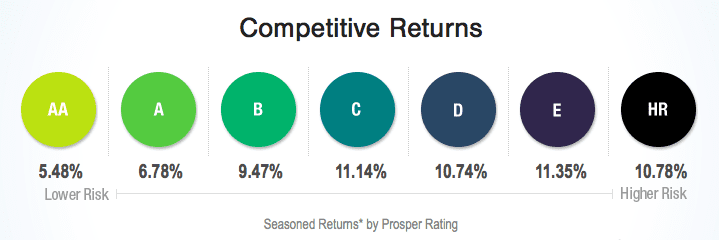

Eligibility for personal loans is not guaranteed and requires that a sufficient number of investors commit funds to your account and that you meet credit and other. Great Tools For Diversification Knowing that some loans will have higher rewards and some lower its best to diversify your investment portfolio. Prosper handles all loan servicing on behalf of borrowers and investors.

Prosper matches borrowers with. Online loans tailored to you - Enjoy the benefits of Prosper Americas first peer-to-peer lending marketplace. Since then Prosper has facilitated more than 12 billion in loans to more than 770000 people.

Fast flexible trusted. Prosper gives you the ability to choose the loans at the risk and reward levels that make you comfortable with lending. Prosper is based in San Francisco that offers personal loans and home equity.

If you are looking for a loan but are a subprime borrower you will no longer qualify with Prosper. As borrowers repay the loan the investors get their money back with an interest. Where the lenders differ are in term lengths and APR.

Payoff lets borrowers select terms ranging from two to. Prosper was founded in 2005 as the first peer-to-peer lending marketplace in the United States. Loans from Prosper are personal loans.

Prosper claims that it originated over 16 billion in P2P loans to 980 people since 2005. P2P marketplaces are different from traditional lenders like banks and building societies because they act as an intermediary between borrowers and lenders. Prosper is a peer-to-peer lending marketplace that allows borrowers to apply online for fixed-rate fixed-term loans.

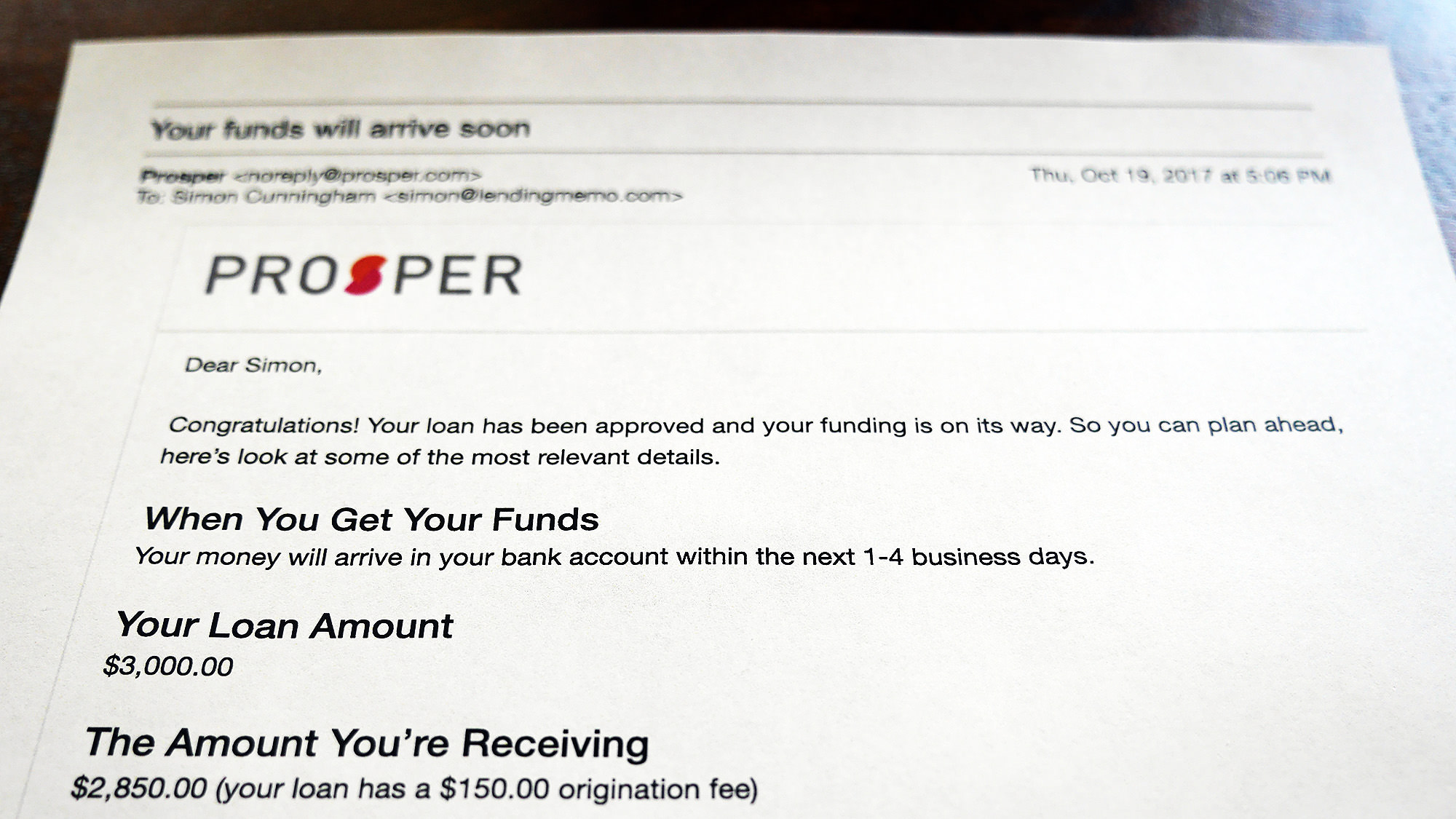

Prosper medical loans are a special subclass of the companys regular peer-to-peer loans. Prosper will lend between a minimum of 2000 6000 in Massachusetts up to a maximum of 35000. Personal loans are unsecured which means that you dont need any.

Prosper loans are unsecured notes like credit cards and not tied to any asset. Eligibility for personal loans up to 40000 depends on the information provided by the applicant in the application form. It is a peer-to-peer lending company that allows regular individuals to invest small amounts of money to cover other peoples loans.

The company says it has originated more than 17 billion in loans to over 1. Prosper Personal Loans Prosper Loans Marketplace Inc is an online peer-to-peer loan facilitation website and online platform. Through Prosper people can invest in each other in a way that is financially and socially rewarding.

Loans can be used for any purpose but the purpose must be stated in. Prosper is a loan company best known for being the first peer-to-peer P2P lender in the US. Prosper features Personal loans.

Prosper was launched in 2005. There is one critical point to consider before applying for a peer-to-peer loan through Prosper. The Prosper application took me less than five minutes to complete.

Prosper Review My Experience Using Prosper

Prosper Review My Experience Using Prosper

Prosper Loans 2021 Personal Loan Review Nerdwallet

Prosper Loans 2021 Personal Loan Review Nerdwallet

Github Ntavou Prosper Loan Exploration Investigated A Dataset From Prosper Lending Platform Using R And Exploratory Data Analysis Techniques Exploring Both Single Variables And Relationships Between Variables

2021 Prosper Personal Loans Review Eine Lohnende Option Wenn Sie Einen Mitunterzeichner Verwenden Mochten Gettotext Com

2021 Prosper Personal Loans Review Eine Lohnende Option Wenn Sie Einen Mitunterzeichner Verwenden Mochten Gettotext Com

Prosper Com Review For New Investors Lend Academy

Prosper Com Review For New Investors Lend Academy

Prosper Loans Reviews Invoice Factoring

Prosper Loans Reviews Invoice Factoring

Prosper Com Review For New Investors Lend Academy

Prosper Com Review For New Investors Lend Academy

Prosper Loans Review For Borrowers Is This Company Legit

Prosper Loans Review For Borrowers Is This Company Legit

Prosper Loans 2021 Personal Loan Review Nerdwallet

Lending Club Vs Prosper 2021 Which Is Better For Investing

Lending Club Vs Prosper 2021 Which Is Better For Investing

Prosper Loans Review 2021 Peer To Peer Marketplace Pros Cons

Prosper Loans Review 2021 Peer To Peer Marketplace Pros Cons

Prosper Loans Prosperloans Twitter

Prosper Loans Prosperloans Twitter

A Plus For P2p Lending Investors To Buy Up To 5 Billion In Loans On Prosper Finovate

A Plus For P2p Lending Investors To Buy Up To 5 Billion In Loans On Prosper Finovate

/prosper-00b97b5f6a844937a0c354916e7af35c.png)

Comments

Post a Comment