If you look only at the first measurehow much the federal government spends per person in each state compared with the amount its citizens pay in federal income taxesother states stand out. 56 rijen Meanwhile only three other states New York 856 Texas 821 and.

Which States Pay The Most Federal Taxes Moneyrates

Which States Pay The Most Federal Taxes Moneyrates

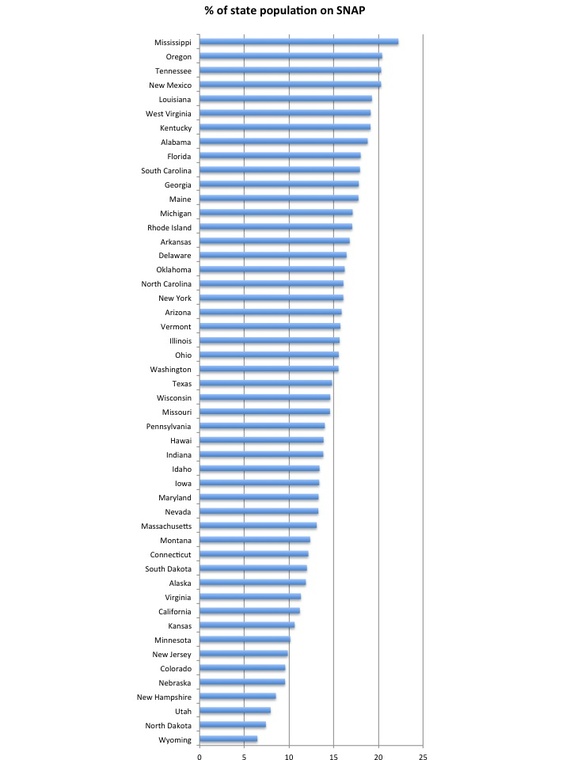

22 to 66 percent.

Which states pay the most federal taxes. 259 to 450 percent. Lets see the states which pay the most to the Federal. Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals families and communities afloat.

10 to 133 percent. 51 rijen Five states have sales tax rates of 000. Alaska Delaware Montana New Hampshire and.

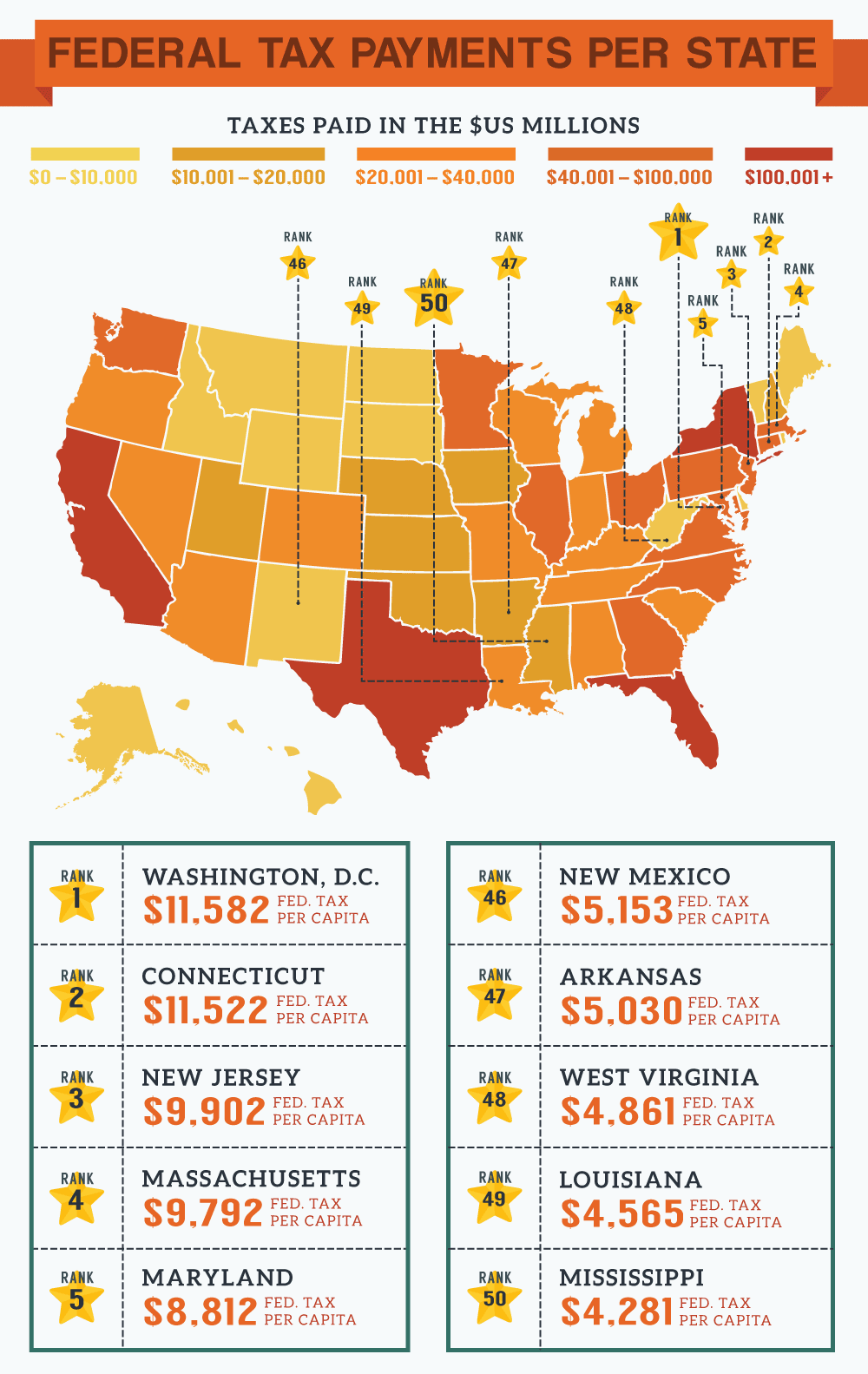

The other 42 states have. California paid 23449 billion followed by New York with 14051 billion and Texas with 13341 billion. States that voted Democrat in 2016 generally rely less on federal funding than Republican states according to a study by WalletHub.

The federal government makes up 4086 of the states government revenue which is the eighth-highest rate for this metric in the study. 20 to 50 percent. However the state progressive tax rates are set at much lower percentages compared to the federal income tax brackets.

According to their report New York leads the nation in sending more taxpayer dollars to the federal government than it gets back in return followed by eight other states. The bottom five states by income tax rate in. Those with AGIs falling between 50000 and 100000 which could be considered middle income paid an effective rate of 925.

Which States Pay the Most Federal Taxes. AGIs of 139713 to 197651 paid an average effective rate of 14. 30 to 699 percent.

Up to 990 3. This year the share of all taxes paid by the richest 1 percent of Americans 243. The analysis looked at the return on taxes paid to the federal.

Not surprisingly nine of the top ten states in federal taxes paid per capita are on the net payers list with Connecticut leading the way at 16052. Youll note that none of these states also make the list for the highest state and local sales taxes so residents do receive a little bit of a break there. 10 to 575 percent.

In 2017 California New York Texas Florida and Illinois paid the highest amount in federal taxes by state. New Mexico is on top of the net taker states with a per capita surplus of 9693. Florida and Illinois contributed 11697 billion and 67180 billion.

Tax season is in full swing and its fair to wonder what youre getting for all your money. 14 to 11 percent. 11 states pay more in federal taxes than they get back heres how every state fares Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi.

Kentucky has the fifth-highest ratio of federal funding to income taxes paid on this list at 120. The 2018 edition of the same study indicated that the bottom half of taxpayers paid an effective tax rate of 37. It turns out for people living in most states the federal government is spending a lot more than its receiving in tax revenue.

Tax season is upon us and while federal income taxes are likely to be the lions share of most Americans tax bills state-level taxes can also weigh. 40 out of 50 states are getting more sometimes a lot more from the federal government than theyre paying in taxes. 20 to 66 percent.

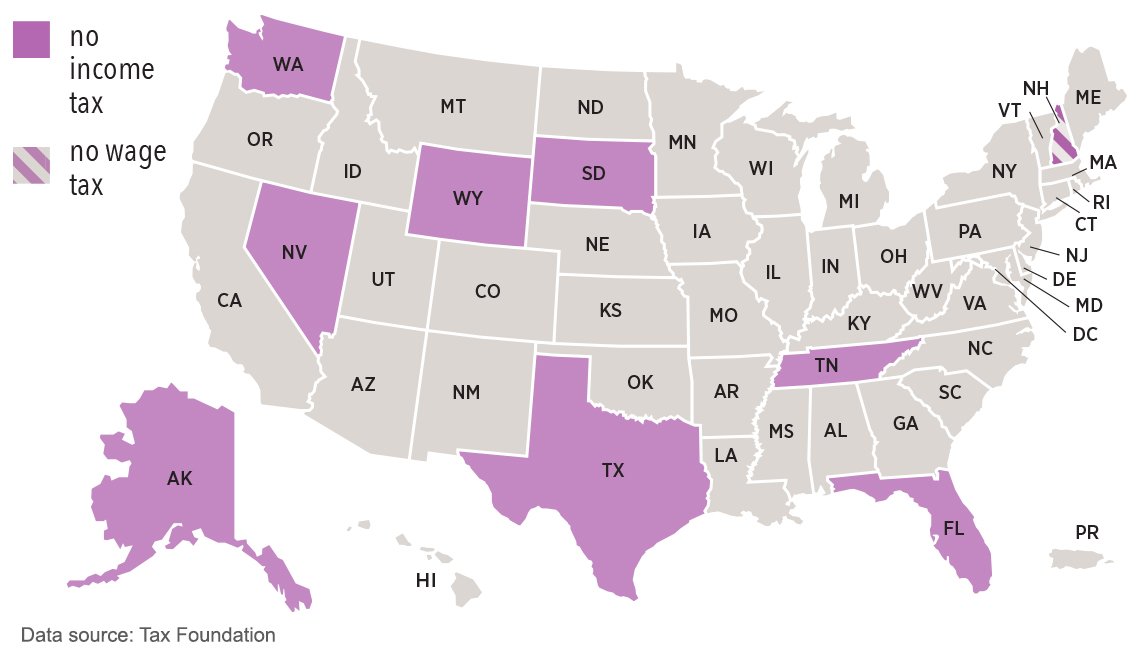

9 States That Don T Have An Income Tax

9 States That Don T Have An Income Tax

Which States Are Givers And Which Are Takers The Atlantic

Is Your State A Net Payer Or A Net Taker Moneytips

Is Your State A Net Payer Or A Net Taker Moneytips

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

States Vary Widely In Number Of Tax Filers With No Income Tax Liability Tax Foundation

States Vary Widely In Number Of Tax Filers With No Income Tax Liability Tax Foundation

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

Which States Are Givers And Which Are Takers The Atlantic

Which States Are Givers And Which Are Takers The Atlantic

Chart Washington D C Pays Most Per Capita Taxes In The United States Statista

Which State Sends The Most Taxes To Washington Hint It S Not A State The Denver Post

Which State Sends The Most Taxes To Washington Hint It S Not A State The Denver Post

United States Federal Tax Dollars Creditloan Com

United States Federal Tax Dollars Creditloan Com

Which States Pay The Most Federal Taxes Moneyrates

Which States Pay The Most Federal Taxes Moneyrates

Is Your State A Net Payer Or A Net Taker Moneytips

Is Your State A Net Payer Or A Net Taker Moneytips

Which States Rely The Most On Federal Aid Tax Foundation

Which States Rely The Most On Federal Aid Tax Foundation

The Week In Public Finance The 10 States That Give More To The Feds Than They Get Back

The Week In Public Finance The 10 States That Give More To The Feds Than They Get Back

Comments

Post a Comment